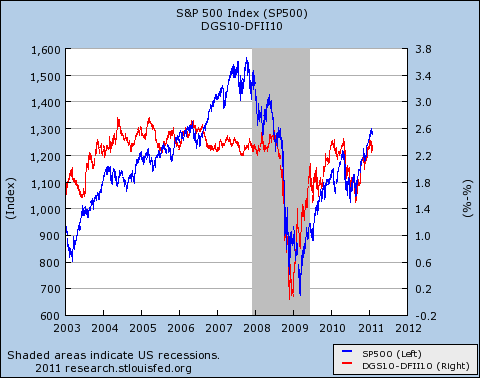

Normally, there’s not much correlation between inflation expectations and asset prices. However, David Glasner has published a new paper showing that, beginning in 2008, this changed dramatically. If I understand his explanation correctly — and I’m not at all sure I do — the mechanism is fairly simple: when you enter a period in which real interest rates  are low and investors expect very low inflation (or deflation), cash becomes your best investment. So investors pull their money out of assets and asset prices fall. In Glasner’s paper, the S&P 500 is a proxy for asset prices, and he finds that, indeed, there’s no correlation of the S&P 500 with inflation expectations through 2007. Then, starting in mid-2008, when interest rates go to zero and inflation expectations fall, the correlation suddenly becomes almost perfect: When inflation expectations drop, so do asset prices. Conversely, when inflation expectations go up, asset prices go up. Scott Sumner is excited:

are low and investors expect very low inflation (or deflation), cash becomes your best investment. So investors pull their money out of assets and asset prices fall. In Glasner’s paper, the S&P 500 is a proxy for asset prices, and he finds that, indeed, there’s no correlation of the S&P 500 with inflation expectations through 2007. Then, starting in mid-2008, when interest rates go to zero and inflation expectations fall, the correlation suddenly becomes almost perfect: When inflation expectations drop, so do asset prices. Conversely, when inflation expectations go up, asset prices go up. Scott Sumner is excited:

There is no way to overstate the importance of these these findings. The obvious explanation (and indeed the only explanation I can think of) is that low inflation was not a major problem before mid-2008, but has since become a big problem. Bernanke’s right and the hawks at the Fed are wrong.

….In my view the time-varying correlations between inflation expectations and stock prices are one of the most important pieces of evidence we have that [aggregate demand] became a problem after mid-2008. It will be interesting to see if those economists who are skeptical of demand-side explanations can come up with a plausible alternative explanation for this pattern.

Paul Krugman agrees: “It’s demand, all the way.” Sadly, neither Glasner, Sumner, nor Krugman explain in terms someone like me can understand why this correlation implies that aggregate demand is what’s behind our economic woes. I feel a bit like a dummy, since they seem to expect this to be obvious, but hopefully someone out there in the econ blogosphere will take pity and explain this in laymen’s terms. When they do, I’ll write a followup. In the meantime, apparently we have one more piece of evidence that our big problem right now isn’t regulatory uncertainty or the federal debt level or structural unemployment. It’s low aggregate demand, just like you’d expect.