Bill Galston says upper-middle-class baby boomers are being selfish in our refusal to pay more for retirement medical care:

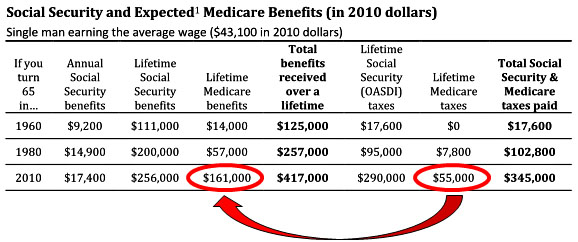

There’s an obvious rejoinder: Haven’t my wife and I already paid into the [Medicare] system for the benefits we’ll receive over the next two or three decades? Answer: Yes, but not enough. A few months ago, Eugene Steuerle and Stephanie Renanne of the Urban Institute put out a very useful summary, “Social Security and Medicare Taxes and Benefits Over a Lifetime,” calculated for different retirement cohorts. While I’m no methodologist, their assumptions seem straightforward and plausible. Applying them to our own case suggests that the value of my contributions falls short of the actuarial value of our benefits by at least $100,000. And if my wife and I were younger professionals scheduled to retire in 2030, the gap would be far greater.

So who’s going to make up the difference? Answer: today’s workers, many of whom are already struggling to raise their children, pay the mortgage, and save for college.

Yep. Here are Steuerle and Renanne’s estimates for a single male retiring last year. Note that this has all been adjusted for inflation:

Given that current and soon-to-be retirees have gotten such a sweet deal, there are several things you can say about Medicare reform. First, if Medicare benefits are going to be reduced, they should be reduced even for current retirees, not just future retirees. Second, if taxes are going to be raised, they should be raised on everyone under 65. There’s no reason that those who are between 55 and 65 should get a free pass. Third, some kind of means testing might be appropriate for Medicare. For a variety of reasons I don’t think means testing is a great idea for Social Security (one of the reasons is here), but for Medicare it might make some sense. As Galston says, for a lot of upper-middle-class boomers like him, the main value of Medicare is guaranteed issue. Everyone over 65 needs that because everyone over 65 has preexisting conditions, but as long as that stays intact a pretty fair chunk of retirees could afford to pay premiums that more accurately reflect the actual cost of their coverage. Something like that would have to be phased in, and it would also have to constructed carefully, but it definitely ought to be on the table when we discuss reforming Medicare. Elderly well-off retirees are still well-off, after all, and there’s not much reason their healthcare should be subsidized by everyone else if they can afford to pay for it themselves.