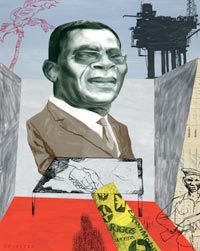

Illustration By: Jeffrey Decoster<br>Map by Baker Vail

The red dirt of the jungle meets a paved road on the outskirts of Ebebiyin, where a national celebration is about to begin. Women are singing and swaying in an African rhythm that is hard to resist, even though their lyrics are not of a can’t-stop-dancing variety: “We await you, Mr. President,” they sing in Fang, the main language in Equatorial Guinea. “We are happy to see you; you are the people’s president.” In the distance, a cloud of Martian dust heralds the arrival of President Teodoro Obiang Nguema Mbasogo.

The president is accompanied by 40 vehicles and enough firepower to start a small war. In the lead are army-green trucks, with soldiers clad in black ninja outfits. Because the president doesn’t entirely trust his military, the jeeps in front of his Lexus SUV bear his Moroccan security guards, many of them perched on the running boards, clutching Heckler & Koch assault rifles as they scan the horizon.

The motorcade halts at the edge of the town and its chickens-in-the-road squalor. Obiang strolls up the street, shaking hands with people who line the uneven sidewalks, many clad in T-shirts and dresses bearing his image. His bearing is regal. If he has any anxiety because of a recent coup attempt, which involved a gang of couldn’t-shoot-straight mercenaries from South Africa and Britain (allegedly financed by the son of former British Prime Minister Margaret Thatcher), he does not betray it. And if his mind is troubled by a recent U.S. Senate investigation detailing how he siphoned millions from his country’s treasury with the help of Riggs Bank in Washington, D.C., and how he and members of his inner circle extracted large and unorthodox payments from American oil companies, that, too, does not show.

Obiang has traveled to Equatorial Guinea’s mainland from his palace on the island capital of Malabo to celebrate the 36th anniversary of independence from Spain. The three-day gala is replete with references to the 1979 overthrow of Francisco Macias Nguema, the nation’s first dictator. Macias, who once tortured and killed political opponents in a soccer stadium, drowning out their screams by playing “Those Were the Days” on the loudspeakers, was ousted and executed in a coup led by a senior military aide who was also his nephew — Teodoro Obiang.

For “El Libertador,” as Obiang allows himself to be called, the highlight of the October celebration is a parade down Ebebiyin’s finest stretch of asphalt. About a hundred goose-stepping soldiers lead the way, and through bouts of equatorial heat and showers, delegations from seemingly every town and organization in the nation march by with banners saluting the president and ruling party.

The heat, the soldiers, the jungle, the out-of-tune band — I was starting to feel I had fallen into a tin-pot time warp. Then I noticed the American flags. These were carried by a delegation from Mobil Equatorial Guinea, Inc., a subsidiary of ExxonMobil. They also carried white Exxon flags and placards bearing ExxonMobil’s name. Behind them came delegations with signs announcing Halliburton, ChevronTexaco, Marathon Oil.

In the past few years, Equatorial Guinea, population 500,000, has become the third-largest oil exporter in sub-Saharan Africa, after Nigeria and Angola. Per capita, it is one of the richest countries on the continent; rated by how much money ends up in the pockets of people not related to the president, it remains one of the poorest. Oil is the reason the desperate-looking cafés and shops in Ebebiyin use ExxonMobil signs as decorations. It is why, although his regime once sent death threats to the U.S. ambassador, Obiang now meets with senior administration officials and even with President Bush. And it’s why no one spoke out as Obiang treated his nation’s treasury as his own private bank account.

Equatorial Guinea sometimes seems a parody of an oil kleptocracy — a Blazing Saddles of the world of petroleum. Yet it has emerged as an all-too-real example of how a dictator, awash in petrodollars, enriches himself and his family while starving his people. His conduct has been aided by American companies: As detailed in Senate and Treasury Department documents, Riggs Bank helped Obiang shuttle millions into offshore accounts. Oil companies, meanwhile, made payments to his regime that the Securities and Exchange Commission (SEC) is now scrutinizing under the Foreign Corrupt Practices Act.

If America’s interest in foreign countries were predicated on human rights, Equatorial Guinea would have seized our attention long before its 1995 oil boom. Francisco Macias Nguema, whose self-bestowed titles included “Leader of Steel,” “The Sole Miracle of Equatorial Guinea,” and, of course, “President for Life,” was a morph of Idi Amin and Pol Pot. He killed or forced into exile nearly a third of the population, decimating in particular the small educated class. Some of his victims were crucified on the road leading to the airport. It was one of the 20th century’s most brutal genocides, but no foreign power except for Equatorial Guinea’s former colonial ruler paid attention to it, and the fascist regime of Spain’s Francisco Franco was not overly troubled by human rights abuses. Obiang’s coup was a welcome event, and his rule has not been nearly as ruthless as his uncle’s. Of course,that’s not much of an achievement.

If America’s interest in foreign countries were predicated on human rights, Equatorial Guinea would have seized our attention long before its 1995 oil boom. Francisco Macias Nguema, whose self-bestowed titles included “Leader of Steel,” “The Sole Miracle of Equatorial Guinea,” and, of course, “President for Life,” was a morph of Idi Amin and Pol Pot. He killed or forced into exile nearly a third of the population, decimating in particular the small educated class. Some of his victims were crucified on the road leading to the airport. It was one of the 20th century’s most brutal genocides, but no foreign power except for Equatorial Guinea’s former colonial ruler paid attention to it, and the fascist regime of Spain’s Francisco Franco was not overly troubled by human rights abuses. Obiang’s coup was a welcome event, and his rule has not been nearly as ruthless as his uncle’s. Of course,that’s not much of an achievement.

Recent State Department reports define Equatorial Guinea as a nominal democracy but note that “in practice power is exercised by President Teodoro Obiang Nguema.” In the latest election, Obiang was reelected with 97 percent of the vote in an election “marred by extensive fraud and intimidation.” “Corruption among officials is widespread,” one report adds; the distribution of oil revenues, meanwhile, has “lacked transparency despite repeated calls from international financial institutions and citizens for greater financial openness.” And finally, “There is little evidence that the country’s oil wealth is being devoted to the public good.”

Human rights abuses continue unchecked. An oil company employee was recently beaten unconscious by gendarmes when he refused to pay a bribe. In 2002, more than a dozen security officials at the airport in Bata, the country’s commercial center, were arrested after they allowed an opposition leader to board a plane for Gabon. If you happen to be a member of the opposition, or even a suspected member of the opposition, you live precariously.

For an intimate portrait of what “torture” and “abuse” mean in the context of Equatorial Guinea, I consulted Tropical Gangsters by Robert Klitgaard, an economist who worked in Malabo during the late 1980s. The book ends with Klitgaard protesting the torture of a local colleague who was taken to the presidential compound above Malabo’s harbor, blindfolded, and had his hands tied behind his back. He was then hung by his ankles — as Klitgaard writes, “like a marlin at the weight scale” — and lowered into a barrel of soapy water and kept there until he choked. He was pulled out, questioned, and submerged again. This went on for several hours. Later, electric shocks were administered to his genitals. He was eventually released.

Even foreign officials have not been excluded from thuggery. John Bennett was the U.S. envoy to Equatorial Guinea from 1991 to 1994, and his outspokenness about such abuses angered Obiang. One evening he received a death threat at the U.S. Embassy. When I talked with Bennett recently, he recalled meeting the country’s president after the incident. “Obiang said he couldn’t believe anyone would threaten the American ambassador,” Bennett said drolly. “It was pretty low comedy.” Soon after, in 1995, the embassy was closed because of concerns over corruption and human rights.

The country might have disappeared from our geopolitical radar had Mobil not struck oil in the waters off Malabo later that year. It quickly became clear that the Zafiro oil field was world-class. After a decade of development, oil production in Equatorial Guinea stands at more than 300,000 barrels a day, which at current prices translates to nearly $5.5 billion a year. A gas field owned by Marathon Oil has also become a major producer, and the ocean beds off Equatorial Guinea are being combed for additional deposits. Energy companies have invested several billion dollars in Equatorial Guinea, and Marathon is building a major liquefied natural gas facility. It is now possible to fly nonstop from Malabo to Texas on a weekly flight known as the “Houston Express.”

Equatorial Guinea is not the only country in the region to have emerged as a major oil supplier for the United States. West Africa is central to America’s effort to reduce dependency on Middle East oil. The region currently supplies 15 percent of America’s energy, and that figure is expected to rise to 25 percent within a few years. A report prepared by the African Oil Policy Initiative Group (AOPIG), a panel of U.S. government and energy industry officials brought together by the Jerusalem-based neoconservative Institute for Advanced Strategic and Political Studies, proposed that the Gulf of Guinea be declared a “vital interest” in U.S. national security policy. The report, unveiled at a press conference in 2002 by several congressmen, proposed that the U.S. military presence be enhanced to include a unified military command for Africa and a home port in São Tomé, an island state in this gulf. Three months later, President Bush convened a meeting with Obiang and nine other Central African leaders at the United Nations to discuss military and energy security. And in a sign of Equatorial Guinea’s new strategic role, a lieutenant colonel in the Special Forces — the U.S. military attaché from neighboring Cameroon — represented the Pentagon in the grandstand at the independence parade in Ebebiyin.

U.S. corporations are now investing more in Equatorial Guinea than in any other African country except for Nigeria and South Africa. In 2003, the Bush administration reopened the embassy, a move sharply criticized by human rights groups as a favor to the oil companies and to Obiang. Frank Ruddy, U.S. ambassador to Equatorial Guinea in the mid-1980s, decries current U.S. policy, saying that Bush administration officials are “big cheerleaders for the government — and it’s an awful government.”

Obiang has few friends. He has alienated the Spanish — and through them the entire European Union — by accusing Madrid of involvement in the March 2004 coup attempt. Aside from the Chinese, only the Bush administration seems to like Obiang. No senior administration official has issued a public word of criticism against his regime. Instead, in June 2004, Secretary of State Colin Powell and Energy Secretary Spencer Abraham each met privately with Obiang in Washington. When I interviewed Gabriel Nguema Lima, Obiang’s son, he warmly saluted the Bush administration: “The United States, like China, is careful not to get into internal issues.”

Equatorial Guinea exemplifies what is known as the “resource curse,” the paradox by which countries rich in oil, gas, or minerals tend to suffer rather than benefit, because the abundance of “easy money” undermines healthy economic and political development. In Nigeria — to cite a classic example — total oil revenues have topped hundreds of billions of dollars, but poverty is worse than it was before the oil rush began more than 20 years ago; corruption is a national sport, and the country is fissuring along ethnic lines.

In Equatorial Guinea, nearly half of all children under five are malnourished. Even major cities lack clean water and basic sanitation. A health consultant who recently visited Equatorial Guinea for the first time since 1993 wrote with dismay in the International Herald Tribune: “Despite the oil boom, I was unable to see any improvements in the living standards of ordinary people.” (Obiang is not among the ordinary: In 1999 he paid $2.6 million — cash — for a mansion outside Washington, D.C. One of his wives had a $10,000 daily limit on her Riggs Bank debit card.)

On my way to Ebebiyin, I was stopped several times by underpaid or rarely paid soldiers who demanded bribes — in their parlance cerveza, or beer money. In the town itself, the main hospital is a place for dying, not healing. The wards are dingy rooms with soiled mattresses and no medical equipment except for a couple of IV drips. By contrast, the town’s sparkling conference hall is air-conditioned and had, during a reception for Obiang’s cabinet the evening before the parade, a 25-foot table stocked with bottles of Johnnie Walker, Smirnoff, and Spanish wine. Apart from such showcase buildings, even government facilities can be decrepit. When I interviewed the minister of education in his office, only one of the two light fixtures had a bulb and I could not tell whether it worked because the power was out.

Yet to Western oil companies, Equatorial Guinea is an ideal partner. Nearly all of its oil and gas reserves are offshore, which means securing the fields is relatively easy. ExxonMobil and Marathon workers live in gated compounds that operate their own electrical, water, and communication systems. Unlike in Nigeria or Saudi Arabia, foreign workers do not face major security threats, and the government’s brutish security apparatus has kept the violent-crime rate low. Expats freely cruise the rutted streets of Malabo in their pickup trucks and hang out at the most popular bars, like La Bamba and Shangri-La, among an abundance of professional women, known as “night fighters” because they bicker over prospective clients.

Most important for oil companies, Equatorial Guinea is a profitable place to do business. According to a 1999 report by the International Monetary Fund, oil companies received “by far the most generous tax and profit-sharing provisions in the region.” The state received only 15 to 40 percent of the revenues from its oil fields, while the norm in sub-Saharan Africa was 45 to 90 percent.

Even so, the government is expected to reap $1.5 billion in oil revenues this year, or about $3,000 per capita. But that figure is deeply misleading; for the average Equatoguinean, scraping by on roughly $2 a day, $3,000 is an unimaginable fortune. So where does the money go?

A basement-level warren in the Russell office building in Washington, D.C., houses the minority staff of the Senate Permanent Subcommittee on Investigations, which focuses on terrorism and money laundering. Its cramped suite is stacked with documents and investigative detritus. In March 2003, responding in part to an exposé by Ken Silverstein of the Los Angeles Times, the subcommittee began investigating Riggs Bank’s compliance with anti-money-laundering laws. It soon uncovered a range of improper activity involving accounts opened by Equatorial Guinea (and unrelated accounts belonging to former Chilean dictator Augusto Pinochet).

The Senate inquiry wasn’t the only government probe of Riggs’ dealings: In a parallel investigation begun in 2003, the Treasury Department’s Office of the Comptroller of the Currency (OCC) started looking into the bank’s Equatoguinean and Saudi accounts. In May 2004, the Treasury Department fined Riggs $25 million for “systemic” violations of anti-money-laundering laws — the largest fine ever imposed under the Bank Secrecy Act of 1970. While offering scant details, Treasury documents refer to “hundreds of thousands of dollars transferred from an account of the country of Equatorial Guinea to the personal account of a government official,” and to “millions of dollars deposited into a private investment company owned by an official of the country of Equatorial Guinea.”

The Senate investigation proved to be much more revealing. Using their subpoena power, investigators obtained records showing that as much as $700 million had been deposited in Equatoguinean accounts at Riggs. The committee also discovered that U.S. energy companies, including ExxonMobil, Amerada Hess, Marathon Oil, and ChevronTexaco, made questionable payments directly to Riggs Bank accounts held by members of Obiang’s regime and his family. What emerges from the committee’s final report, released in July 2004, is an intricate exposé of how Obiang enriched himself and his family, and how oil companies, wittingly or not, helped him do so.

Although Riggs is only a medium-sized bank, it has been a D.C. institution for more than a century. Riggs has always been well connected — 21 presidents have used its services — and Jonathan Bush, the president’s uncle, is CEO of its investment arm. Riggs has also long been the banker to Embassy Row, and in recent years, embassy banking accounted for 20 percent of its revenue. Its client list, Senate investigators wrote, included many countries “with high risks of money laundering and foreign corruption.”

Riggs also has a reputation for not asking too many questions. As the committee report notes, “Riggs has repeatedly been cited for having weak anti-money-laundering controls.” Indeed, the document went so far as to call the bank’s program “dysfunctional.” This certainly held true in Riggs’ treatment of Obiang’s money: “Riggs was fully aware of the corruption risks associated with the E.G. accounts,” Senate investigators reported, yet the bank “failed to exercise enhanced scrutiny of the account activity, even for transactions involving large cash deposits or international wire transfers.”

Obiang’s relationship with Riggs began in 1995, and by 2003 his regime had become the bank’s single largest customer. In all, Riggs held more than 60 accounts belonging to Obiang, his government, and his ruling circle. The primary Equatoguinean bank account, known as the “oil account,” was where energy companies would deposit their royalty payments, and it often contained tens of millions of dollars at a time. There is no suggestion that those payments themselves were tainted, but Obiang’s handling of the account raised eyebrows. Among other suspicious activity identified in the report, the regime wired — without objection or scrutiny from Riggs — $35 million from the oil account “to two unknown companies” with accounts in nations with strict bank-secrecy laws.

Then there were the “investment accounts.” In 2003, the value of these accounts fluctuated between $300 million and $500 million. It is unusual for funds tantamount to a country’s treasury to be held in a private bank, especially a relatively minor one like Riggs, and even more unusual for transfers from such accounts to require only one signature — the president’s. That’s just one of the reasons Obiang is believed to have treated the public treasury as his own.

The handling of the accounts might have been comical if a nation’s wealth hadn’t been at stake; the manner of deposits was, on occasion, Chaplinesque. The Riggs official who managed the accounts from the bank’s DuPont Circle branch, Simon Kareri, twice went to the Equatoguinean Embassy, a mile away on 16th Street, and picked up suitcases that, as detailed in the Senate report, weighed 60 pounds and contained $3 million in plastic-wrapped stacks of $100 bills. He ferried them back to Riggs and deposited them into one of Obiang’s accounts. The bank also received cash deposits of more than $1.4 million into accounts belonging to Constancia Nsue, one of Obiang’s wives. In those cases — as with other cash deposits that larded accounts controlled by Obiang and Nsue — Riggs did not file “Suspicious Activity Reports” to the OCC as required whenever a bank suspects, or should suspect, that a transaction might involve illicit funds or the laundering of illicit funds.

(The oil account, as well as the others, was closed after the Senate investigation began, and Obiang’s government says that the funds are currently deposited at the Bank of Central African States, a regional institution based in Cameroon that holds treasury accounts.)

The committee reported a litany of other unorthodox activity. Riggs helped Obiang set up Otong S.A., an offshore shell corporation in the Bahamas to which he deposited $11.5 million in cash. Reporting these transactions to U.S. officials, Riggs “repeatedly mischaracterized” Otong as a “timber export company.” Riggs also issued a $3.75 million loan to Obiang’s eldest son, Teodoro Nguema Obiang, to purchase a penthouse apartment in California. (Teodoro, owner of a fleet of Ferraris, Lamborghinis, and Bentleys, started a rap label in Beverly Hills.) But not all of the transactions were to Obiang’s benefit: The bank “exercised such lax oversight” over Kareri, the manager of the Equatoguinean accounts, that he was able to “transfer more than $1 million in E.G. oil revenues to an account he controlled at another bank.”

As the Senate report concluded, “Riggs Bank serviced the E.G. accounts with little or no attention to the bank’s anti-money-laundering obligations, turned a blind eye to evidence suggesting the bank was handling the proceeds of foreign corruption, and allowed numerous suspicious transactions to take place without notifying law enforcement.” Riggs officials declined to comment for this story.

The committee’s rebuke did not end with Riggs. “Oil companies operating in Equatorial Guinea,” Senate investigators wrote, “may have contributed to corrupt practices in that country by making substantial payments to, or entering into business ventures with, individual E.G. officials, their family members, or entities they control, with minimal public disclosure of their actions.” Those conclusions triggered the current inquiry by the SEC into oil company transactions. Although the SEC won’t comment on ongoing investigations, it is understood to be probing possible violations of the Foreign Corrupt Practices Act, which prohibits American companies from making direct or indirect bribes. (The oil companies deny wrongdoing and say they are cooperating with the SEC.)

Among the payments were more than $4 million that American oil companies, including ChevronTexaco, ExxonMobil, Marathon, and Amerada Hess, provided to fund the tuition and living expenses of Equatoguinean students in the United States. According to the Senate report, most of these students “appeared to be children or relatives of wealthy or powerful E.G. officials.”

The Senate report also describes payments the oil companies made to Obiang and his inner circle. About half of the 60 Equa- toguinean accounts at Riggs belonged to members of Obiang’s family or government (who were often the same, as in the case of Armengol Ondo Nguema, Obiang’s brother and the director of national security). Between 1995 and 2004, millions of dollars from U.S. oil firms were deposited into these accounts — for what appeared to be real estate or business deals — and some of these funds were transferred to offshore accounts. Such payments were made to, among others, the president’s wife, the interior and agricultural ministers, and at least one well-placed general.

In 2001 Exxon paid $175,000 to Constancia Nsue — as a representative of Obiang’s personal company, Abayak S.A. — to rent a compound that houses Exxon workers and offices. Exxon also rented a house from the nation’s minister of agriculture and paid $236,160 to a firm owned by the interior minister. The prize for the most unusual lease goes to Amerada Hess, which rented property for $445,800 from a 14-year-old relative of Obiang. Overall, Hess paid nearly $1 million in rent to Equatoguinean officials and their relatives, though the company told the Senate committee it planned to cancel those leases in 2004.

How much is too much to pay in rent to a teenager, to a general, to the president’s wife? There’s no easy answer. Equatorial Guinea is not a normal country: One resident remarked of the ruling elite, “Everything you see that attracts your attention is owned by them.” A foreigner who knows the country well described it to me as “a ranch” owned by Obiang. If the president or his relatives don’t happen to own something you want, they will likely acquire it before you do and then sell it to you at a tidy profit. As the Senate report notes, this type of “economic dominance” means that almost any business deal is likely to enrich a member of the president’s clan. “How oil companies can and should respond to this situation,” the report notes, “raises a number of difficult policy issues.”

Unfortunately, the Bush administration is setting an abysmal example. The building it settled on to house the reopened embassy is owned by Manuel Nguema Mba, who is the minister of national security, a relative of Obiang’s, and an accused torturer. The State Department and the United Nations Commission on Human Rights have both documented cases in which Nguema supervised the torture of political opponents. In one case the victim was beaten to death. Now Nguema collects rent from the U.S. government.

After issuing its report, the Senate committee held a hearing in which the head of Riggs Bank, as well as senior executives of ExxonMobil, Marathon Oil, and Amerada Hess, testified under oath.

Kareri, the Riggs official who oversaw the accounts, took the Fifth. But the bank’s president and chief executive officer, Lawrence Hebert, did speak, voicing regret that Riggs did not “fully meet the expectations of our regulators.” He blamed the absence of suspicious activity reports on a subpar computer system.

Senator Carl Levin (D-Mich.), the ranking minority member, was amazed. “Mr. Hebert,” he said, “you don’t need a computer system to realize suspicious activity when you’ve got 60 pounds of cash there being walked into the door with a suitcase.”

Levin was just warming up. He noted that Riggs hosted a lunch for Obiang in Washington, and that Hebert and three other executives had followed up with a letter expressing the bank’s “gratitude” for Obiang’s time and saluting his “prudent leadership.”

“How do you write that stuff to a man as abominable as this guy?” Levin asked. “How do you basically live with yourself?”

“We took prudent steps to be very careful with this gentleman,” Hebert replied.

“Who you calling a gentleman?” Levin shot back. “Let’s call him a dictator.”

Next were the oil executives. Andrew Swiger, then an executive vice president at ExxonMobil, was first to testify. “The business arrangements we’ve entered into have been entirely commercial,” Swiger said. “They are a function of completing the work that we are there to do, which is to develop the country’s petroleum resources and, through that and our work in the community, make Equatorial Guinea a better place.”

“Make it what?” Levin asked.

“A better place,” Swiger replied.

“I know you’re all in a competitive business,” Levin said in closing. “But I’ve got to tell you, I don’t see any fundamental difference between dealing with an Obiang and dealing with a Saddam Hussein.”

Obiang’s personal investment vehicle is Abayak S.A., and it was to Abayak that the oil companies made a number of their questionable payments. The company is mysterious — nobody seems to know how big it is, or exactly what it does. But an internal Riggs memo unearthed by the Senate describes it as “a significant earner of income for the President.” So I decided to make inquiries once I arrived in Equatorial Guinea.

According to the Senate report, Marathon Oil has negotiated a deal to purchase land from Abayak for more than $2 million; although much of the sale, as of June 2004, was pending, the oil company had already delivered a check to Abayak for $611,000, made out to Obiang. Marathon is also involved in a joint venture to operate two gas plants with GEOGAM, a quasi-state firm in which Abayak controls a 75 percent stake.

ExxonMobil operates an oil-distribution joint venture, called Mobile Oil Guinea Ecuatorial, in which Abayak owns 15 percent, based on a mere $2,300 investment. ExxonMobil has not disclosed the company’s revenues or current valuation.

What did Abayak offer its American partners other than the name and blessing of the president? I thought the answer could be found in Bata. The recently completed seven-story Abayak building is the biggest building in Bata — indeed, the largest one in the country. I asked a Ministry of Information official to take me to see Abayak’s headquarters so that I could talk with an executive or two.

At the ground-floor reception area, we were told the firm’s offices were on the top floor. When we went there, we found that four of the six offices on the floor were empty and not even furnished. Doors to the two remaining offices were locked and unmarked. If these were Abayak’s headquarters, they seemed unfathomably modest for a firm that had been selected as a partner by the largest oil companies in the world.

Perhaps the receptionist was wrong; maybe Abayak’s offices were on another floor. I checked every floor and saw that the offices were either empty — most were — or occupied by other entities. Even the Ministry of Information official who accompanied me was flummoxed. Where was Abayak? And more to the point, what was Abayak?

There were answers back in Malabo. I talked with two people who follow the nation’s financial affairs closely (and who asked not to be identified because they would face retribution from the government). One told me that, as far as he knew, Abayak conducted some legitimate business but functioned mainly as a vehicle through which payments were made in exchange for the president’s approval of business projects. The other person called Abayak a “holding company” and said it had no administrative offices that he knew of. Indeed, there is no Abayak building or administrative offices in Malabo that I could locate. It was not possible to ask the president about this or any other matter — my requests for an interview were declined. So I went to the next-best source, his son Gabriel Nguema Lima, who, in high Equatoguinean tradition, is also the vice minister of mines and energy.

Obiang has several wives and many children — some accounts put the number at 40 — but the two children who count the most are Teodoro, the eldest son of Constancia Nsue, and Gabriel, the eldest son of Obiang’s second wife. Due to his playboy habits, Teodoro has faded somewhat in the past year while Gabriel, who is smart and hardworking, has taken a larger public role even though he is not yet 30 years old.

His Malabo office is in the ministry headquarters, a modest two-story building where, on the day of my interview, a rooster was pecking around the front yard. The office, though it has a flat-screen computer, is not large — in most governments it would house a mid-level civil servant. Adorning the wall is Nguema’s diploma from Alma College and his varsity soccer letter from prep school Cranbrook Kingswood, both in Michigan.

Nguema has become a spokesman for his father on financial affairs, so I asked about the Riggs controversy. “If Equatorial Guinea wanted to do something illegal,” he said, “the easy thing would be to do a Swiss account or a Bahamas account where nobody will know what happens.” He claimed his government used Riggs because the U.S. State Department had recommended the bank: “We wanted to make sure that American companies feel comfortable.”

When I asked Nguema about Abayak, he described it as an industrial concern with experience in the cement and cocoa businesses. I told him that I had been trying to locate the company’s headquarters.

He scratched his head.

“Uhm, headquarters of Abayak, that’s a good question,” he said, pausing uncomfortably. “I don’t think they have a headquarters here. I know they work from here, but they don’t have a headquarters here. The headquarters would be” — he paused again and looked at his feet — “maybe my father’s house.”

As with most dictatorships, Obiang’s regime does not like reporters nosing around. I let the authorities know that I was working on a book about oil, and they had not seemed particularly concerned about my presence until I took a stroll with the Spanish ambassador, Carlos Robles Fraga. What ensued provided an unexpected lesson in the clout the U.S. government carries in Equatorial Guinea.

I happened to meet Robles while I was in Ebebiyin for the celebration. We walked around the town square, an area thick with security officials, and had an innocuous 10-minute conversation. The next day, an adviser to Obiang called my cell phone and demanded I leave the celebration because I had met “the enemy.” After a few hastily arranged meetings and many reassuring words, the problem seemed to have blown over. But two days later the minister of information, Alfonso Nsue Mokuy, came to my hotel with a presidential aide in tow.

“Peter, you have caused us enormous problems,” he said. “The president has called me three times, and him,” nodding to the presidential aide, “four times.”

I was startled that the president would concern himself so intimately with my case.

“Was he angry?” I asked.

“We are all angry,” the minister replied. I would have to leave the country.

I was driven by the adviser to the airport, where my passport was taken and I was told to wait in the international departure lounge. When I tried, an hour later, to send an email, I was taken to a security office, where the minister of information soon appeared, sweating like a boxer in the 10th round. He was yelling at me, a bit incoherently.

“You are a spy,” he said, waving his finger at me. This was nonsense, I replied, and, remembering the call-the-bluff strategy of a colleague in Baghdad who was accused of espionage by Saddam Hussein’s security service, I said that if he believed I was a spy he should take me to prison straightaway.

“Let me see your computer,” he demanded. Apparently I was not quick enough to open my bag because the minister slapped at my forearms and told me to hurry up.

“If any harm comes to me, there will be a big problem between your government and my government,” I said sternly.

“Are you threatening me?” he asked, mentioning that in a week or so he would be visiting Washington for official meetings.

“If you do anything to me, you will not be going to Washington,” I warned.

He backed down. If what I said was true — and I had as little idea of that as he did — he would be doing something worse than angering his own president; he would be angering the president’s all-powerful friend. He didn’t touch me again.

Two days after my expulsion, President Obiang met with the chargé d’affaires of the U.S. Embassy, who had come to the airport to make sure I was treated fairly before I was made to board a turboprop to Cameroon. Obiang apologized for my expulsion, saying there had been a misunderstanding, and he invited me back as his personal guest. His apology was surprising: Presidents, in democracies and dictatorships alike, don’t like to say they made a mistake. But Obiang did, and the most reasonable explanation is that he fears displeasing the U.S. government, his indispensable ally.

Unless something changes, Equatorial Guinea is cursed; it is ruled by an elite that has shown little conscience or judgment in the realms of economic and political development. It is a safe bet that much of the oil money will be stolen or squandered by Obiang’s regime, even if the American government and oil companies do what is within their power to do. Yet that margin of difference — reducing the curse from total to partial — is well within reach.

It is not a radical agenda. The report by AOPIG, the neoconservative group of government and energy industry officials, argues that it is against U.S. interests to support unsavory regimes, and that the solution is to engage them “in a way that fosters and encourages the development of a middle class, rather than allowing petrodollars to flow into the hands of a small number of corrupt leaders and their associates.” In other words, don’t go into business with the Abayaks of the world.

The Senate recommendations are more aggressive. “To further reduce opportunities for corruption, U.S. oil companies should not participate in future business ventures in which individual E.G. officials or their family members have a direct or beneficial interest,” the report concludes. “Congress should also amend the Foreign Corrupt Practices Act to require U.S. companies to disclose substantial payments to and business ventures entered into with a country’s officials, their family members, or entities they control.”

The bottom line is that Equatorial Guinea is a country in which the Bush administration — which proclaims a vast interest in promoting democracy around the globe — could make a difference, if it wished. When it makes a demand, Obiang listens because he must. Militarily and politically, he’s a paper tiger. Last March, a gang of fewer than 100 inept mercenaries came close to killing him, which is why he has reinforced his Moroccan security detail and paid an estimated $50 million for several Ukrainian attack helicopters. Yet he knows it is well within the power of the U.S. government to depose him — or, at least, curb his kingly ways.

For people in Equatorial Guinea, the U.S. government may be their only and perhaps last hope. While in Malabo, I would often take an evening stroll from my hotel and sit on the steps of a building overlooking an intersection with a colorful whirl of activity. The street lights worked only occasionally, but a nearby bar played irresistible music from the Ivory Coast, and vendors sold snacks to the men and women who talked and flirted in the near-darkness.

Almost every time I visited that spot, I met a man on the steps. He was an ordinary Equatoguinean, which means he was jobless and struggled to feed his family, yet he was hopeful that things might improve because Americans had taken an interest in his country. We always talked, and because I never asked his name, he talked freely.

“Obiang doesn’t care about the people, only his family,” the man said. “He doesn’t want to share the money. He says he wants democracy, but if I say to him these things, I will go to jail and be killed. It is our brother who is killing us. The whites, they should help us. Saddam Hussein, he was a dictator, and the whites decided to get rid of him. They should help us, too.”

By “whites” he meant “Americans.” We are the ones offering jobs to a lucky few workers. In his eyes, we are the ones who stand for democracy and a future that is not filled with theft and violence by a government mafia. We are a good people who will do what is right — or should do what is right.

“Don’t forget me,” I heard him shout, after our last conversation, as I walked away.