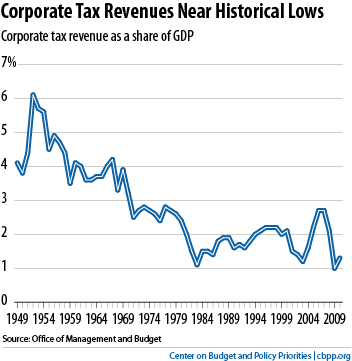

From CBPP, the chart below shows how much American corporations have paid out in taxes over the past 60 years. It’s hovering around 1% of GDP these days. As Chuck Marr says, “Although the top statutory corporate tax rate is high, the average tax rate — that is, the share of profits that companies actually pay in taxes — is substantially lower because of the tax code’s many preferences.” Needless to say, this is despite the fact that corporate profits have been quite robust in the United States over the past few decades.

Marr has some suggestions for reforming the corporate tax code, while I remain willing to do away with corporate taxes entirely and replace them with something else. In the meantime, though, keep this chart in mind whenever corporate titans start whining about how monstrous their tax load is. They’re lying.