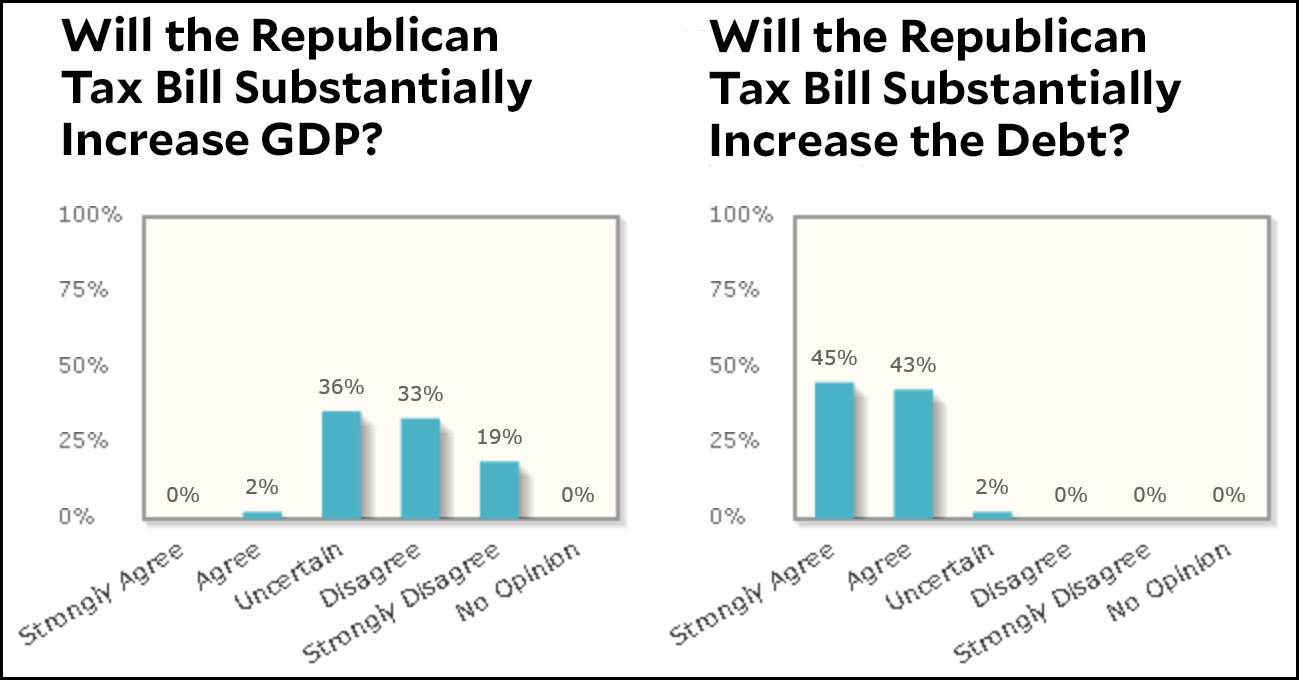

The latest question put to the IGM Economic Experts Panel was about the Republican tax plan. Without further ado, the results:

Will it increase GDP? Oh hell no. Will it increase the debt? Hell yes. It’s designed to increase the debt.

My favorite answer to Question 1 comes from Oliver Hart of Harvard: “The incentive effects are unclear to me. Some of the simplifications make sense but many of the changes look like hand-outs to the rich.”

You don’t say? Austan Goolsbee of the University of Chicago wins for his answer to Question 2: “Cut taxes. Lose money. Repeat.”

What a mess. There’s really no reason to think that corporate taxes are too high in America, but it’s still possible that legitimate tax reform could help the economy. That calls for a tax bill that simplifies the corporate code; thoughtfully reforms our current worldwide taxation system; reduces industry subsidies and tax preferences; moderately lowers rates; and ends up revenue neutral. Unfortunately, what we have is a tax bill that includes a few useful features buried inside a chaotic assortment of giveaways to the wealthy and other special interests. It’s unlikely to accomplish much except to make a few rich people about $1.5 trillion richer over the next ten years. Even most conservatives support it only tepidly.

But if there’s a single thing in this bill that demonstrates the difference between Republicans and Democrats, it’s not the favoritism toward the rich. I pretty much take that for granted these days. Rather, it’s the treatment of worldwide income.

There’s broad agreement that the US system, which taxes all the income of domestic companies but provides credits for taxes paid to foreign countries, is clumsy and inefficient. Most countries rely instead on a territorial system that taxes only income earned within their borders. This is something that Republicans could have taken on and that the business community would likely have supported. The problem is that it’s not a simple matter that fits on a bumper sticker or gets cheers at a rally. Transitioning to a territorial system is complex and full of potholes.

If this were a Democratic priority, liberal think tanks would have spent the past decade churning out dozens of detailed models and white papers, and legislative aides would be ready to dive in and start working on it. But if you scan conservative think tanks, you’ll find a few op-ed length proposals for a territorial tax and not much more. Not enough, anyway, that Republicans felt confident about taking it on this year. They just don’t care enough about detailed policy to be able to do stuff like this. So instead they threw a few ideas in the air, tossed out the ones that got any pushback, and ended up with an embarrassing collection of hobbyhorses and giveaways. It’s the same story as health care: after seven years of denouncing Obamacare, Republicans had little more than a few bullet points to work with when it turned out they couldn’t just repeal the entire law and be done with it. Detailed replacement proposals were almost nonexistent.

Republicans can blow raspberries at honest wonks all they want, but this is the result: For anything complex, they’re incapable of passing legislation that’s worthwhile even from their own point of view.