With the economy in shock thanks to COVID-19, the obvious response from the federal government is to spend lots of money to cushion the blow. This would not only help out businesses and individuals—a worthy end in itself—but massive deficit spending would also help kick start the economy as a whole. Still, there’s a limit to how much we can blow up the deficit. The question is: What is that limit?

The downside of deficit spending is that if you do too much of it you’ll touch off a surge of inflation. This is what limits our tolerance for deficits when the economy is already in good shape. But what if the economy is in a deep recession? Then we should spend whatever it takes to get the economy fully back on its feet. There’s no reason to stop until we start to see signs of growing inflation.

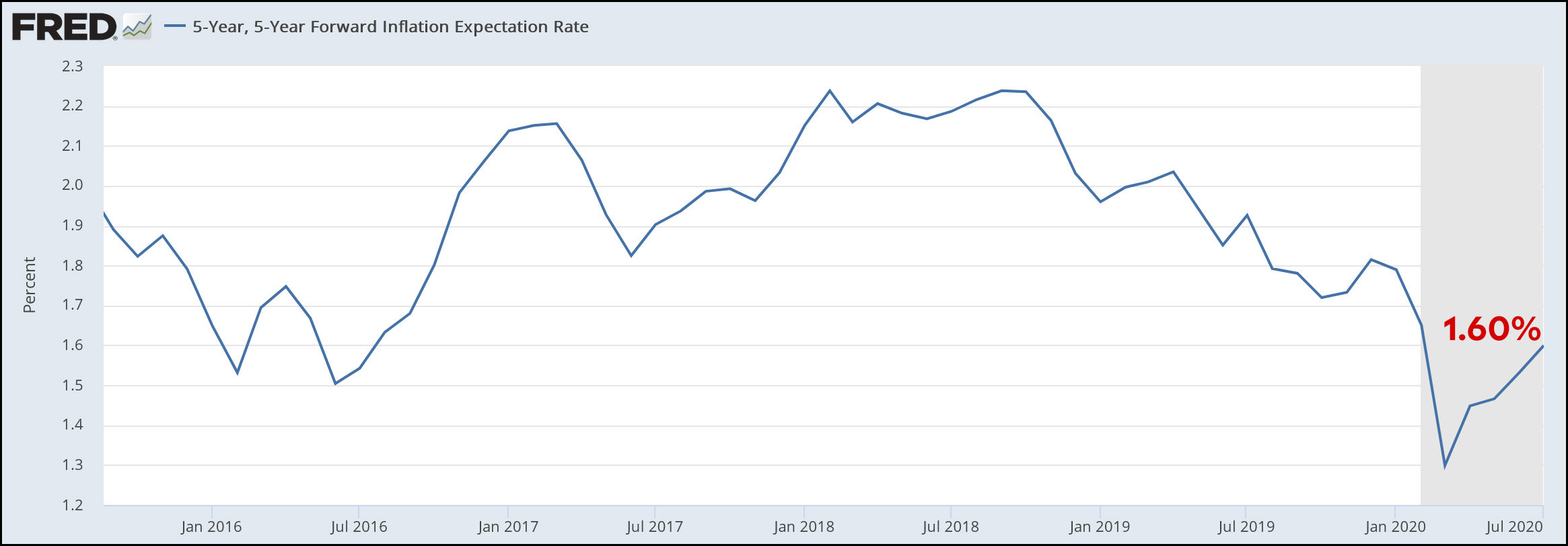

So what about now? Obviously we’re in a deep recession that calls for enormous spending. Nonetheless, we need some touchstone that tells us if spending is out of hand and we’re running up deficits too quickly. That touchstone is inflationary expectations, and there are lots of ways of estimating it. Here’s a whole bunch of them. First off is what’s known as the 5-year/5-year forward inflation expectation rate:

Next up is the 10-year breakeven rate:

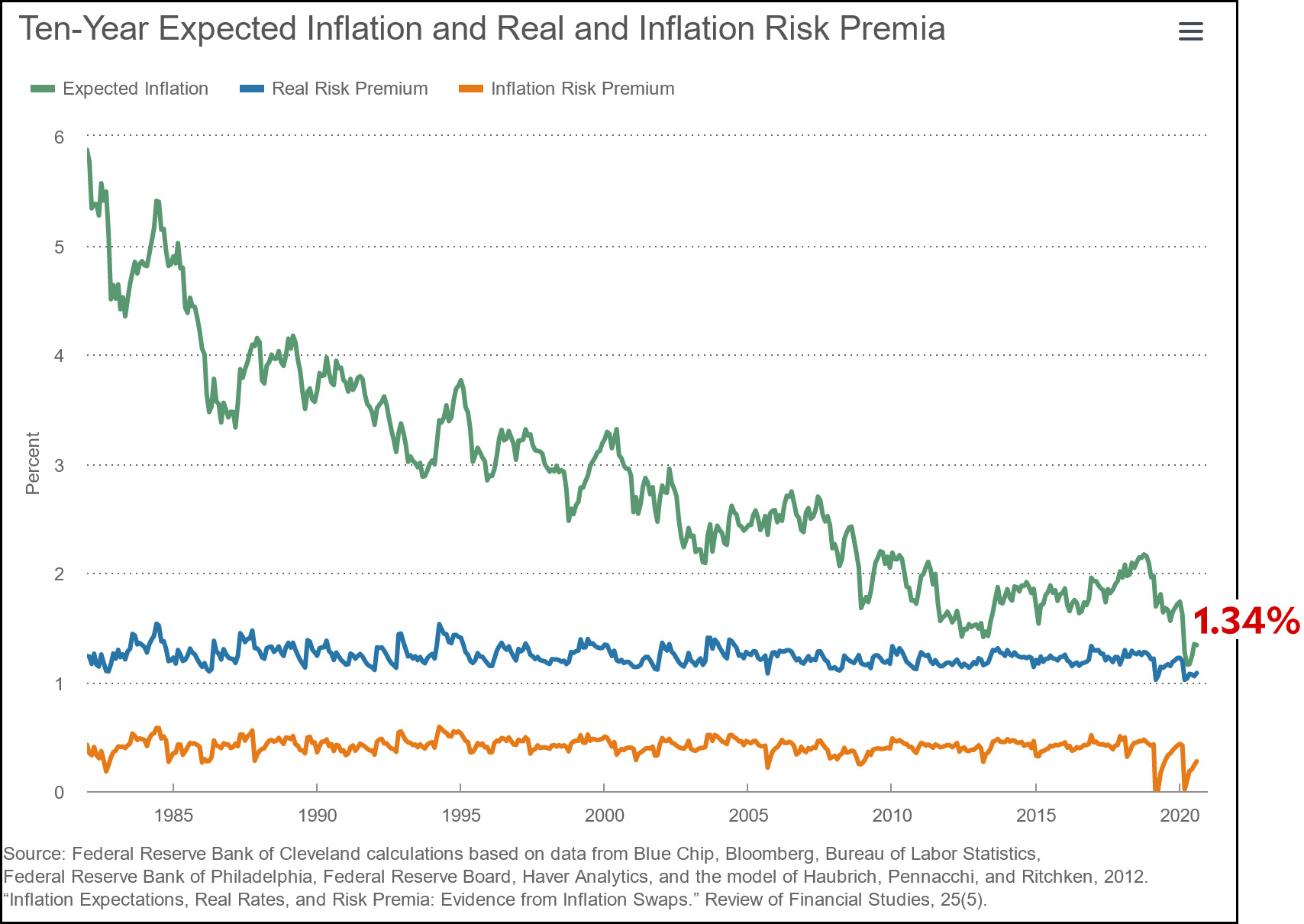

Here is the Cleveland Fed’s 10-year forecast:

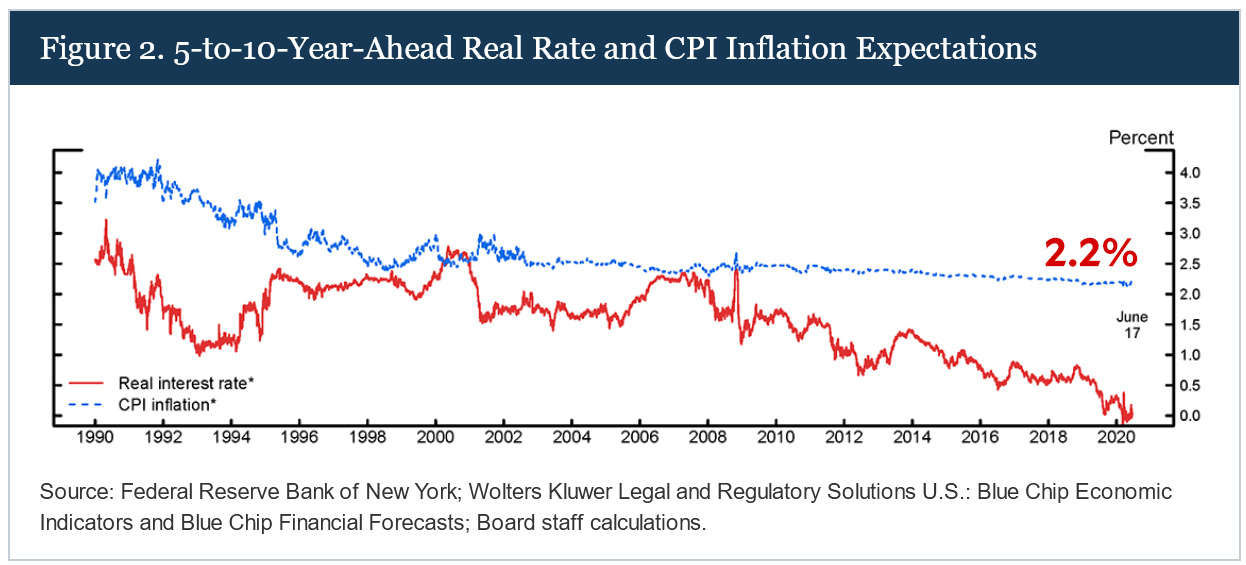

Here’s a forecast from the Fed Board of Governors:

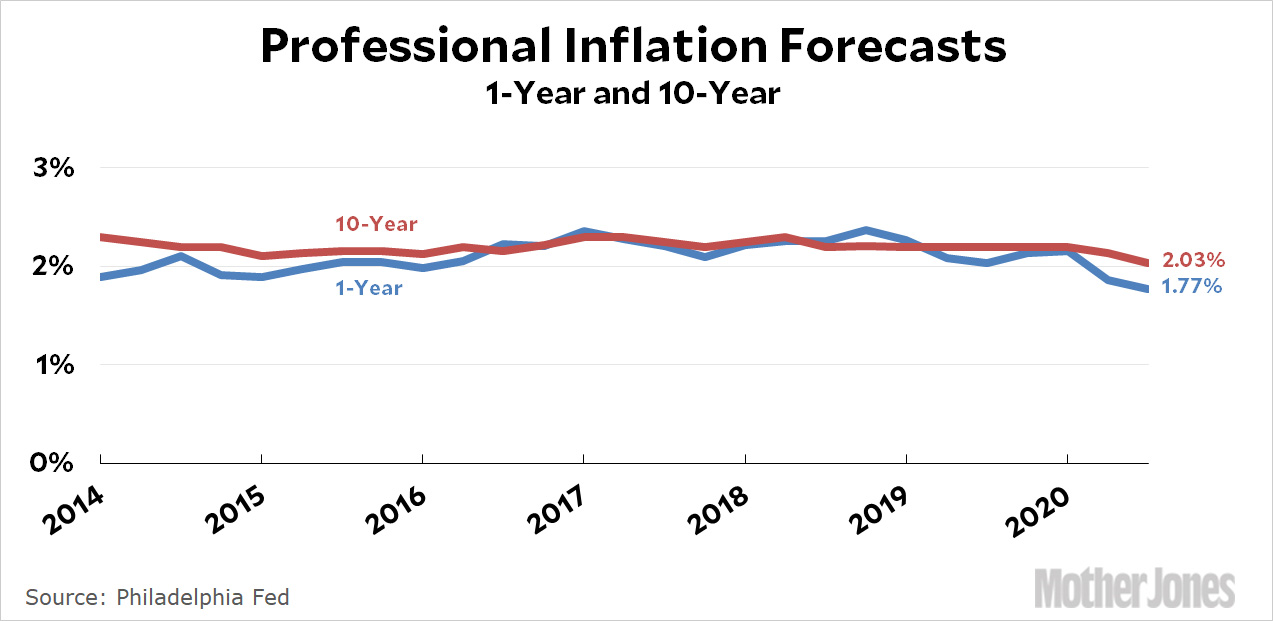

Here’s the consensus forecast from professional economists:

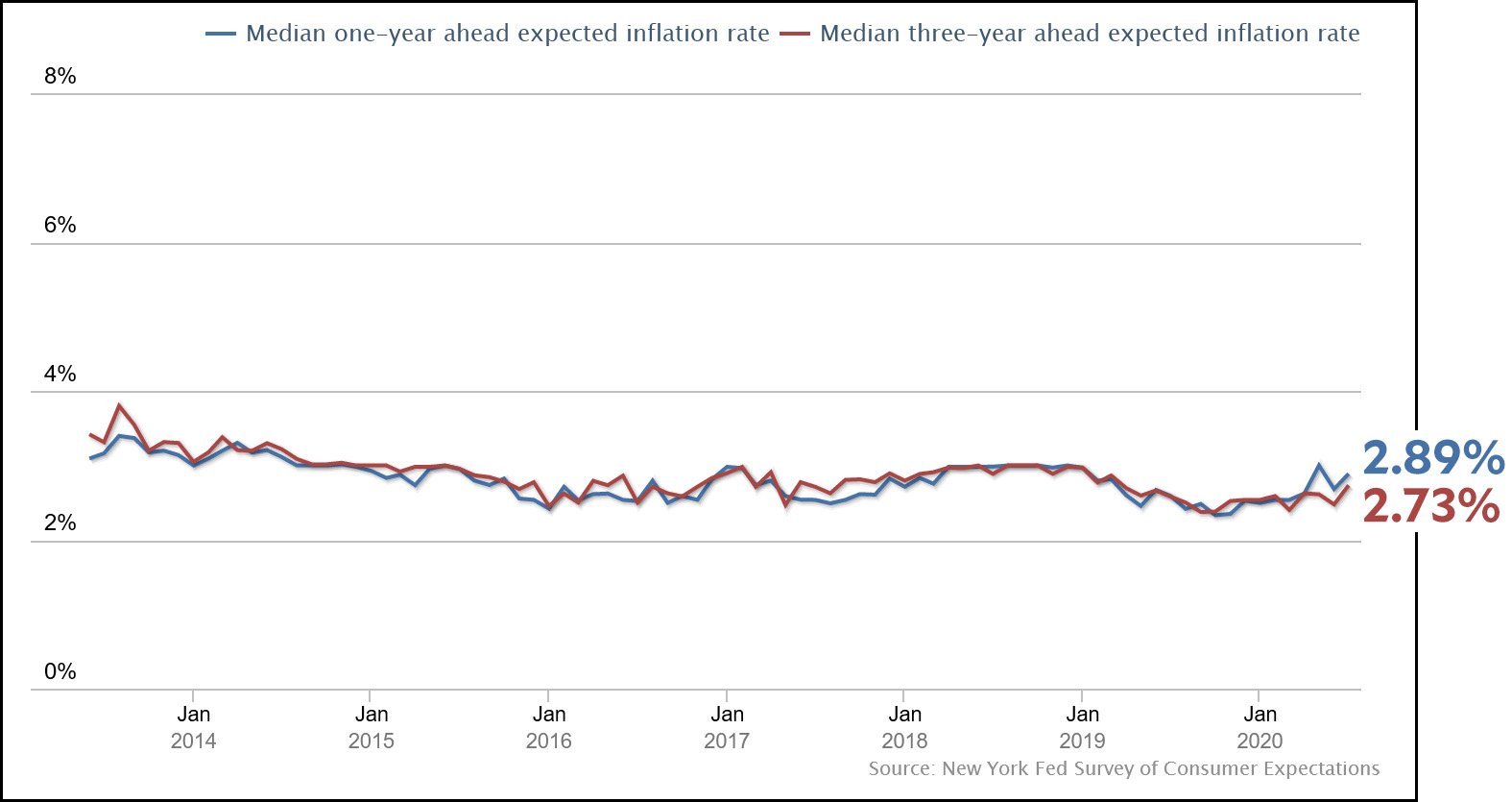

Here are consumer expectations:

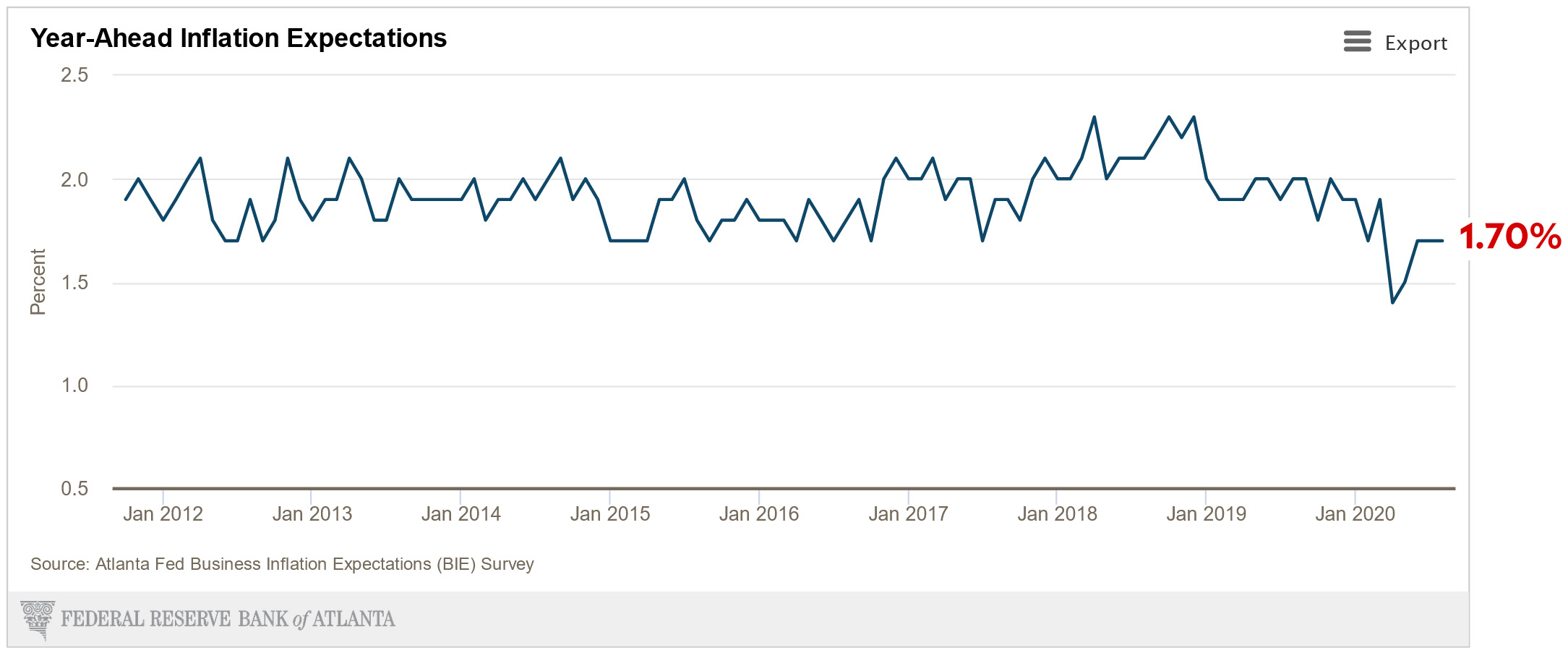

And here are business expectations:

Bottom line: Nobody, literally nobody, sees even the slightest inflationary pressure causing a problem over the next ten years. The average forecast for 1-10 years is under 2 percent, about the same as it’s been for the past decade.

But wait! What if all these forecasts are wrong? Then we’ll get plenty of warning. Inflationary expectations will rise steadily until they get to a point where policymakers need to start getting worried. Right now, though, we aren’t within light years of that. With an economy in the doldrums—and a worldwide economy that’s obviously not going to help us out—we should be spending huge amounts of money and running up the deficit until we get at least a flicker of rising inflation. This is why Fed Chair Jay Powell is practically begging Congress to spend more money.

We need to spend lots of money. We need to run big deficits. It’s the only way to save the economy, and we shouldn’t even think about slowing down until inflationary pressures start to seriously rise. That’s probably at least a year away, maybe more.