The simulator control room at NuScale Power's small modular reactor design facility in Oregon.NuScale Power

This piece was originally published in Yale Environment 360 and appears here as part of our Climate Desk Partnership.

Huge computer screens line a dark, windowless control room in Corvallis, Oregon, where engineers at the company NuScale Power hope to define the next wave of nuclear energy. Glowing icons fill the screens, representing the power output of 12 miniature nuclear reactors. Together, these small modular reactors would generate about the same amount of power as one of the conventional nuclear plants that currently dot the United States—producing enough electricity to power 540,000 homes. On the glowing screens, a palm tree indicates which of the dozen units is on “island mode,” allowing a single reactor to run disconnected from the grid in case of an emergency.

This control room is just a mock-up, and the reactors depicted on the computer screens do not, in fact, exist. Yet NuScale has invested more than $900 million in the development of small modular reactor (SMR) technology, which the company says represents the next generation of nuclear power plants. NuScale is working on a full-scale prototype and says it is on track to break ground on its first nuclear power plant—a 720-megawatt project for a utility in Idaho—within two years; the US Nuclear Regulatory Commission has just completed the fourth phase of review of NuScale’s design, the first SMR certification the commission has reviewed. The company expect final approval by the end of 2020. The US Department of Energy has already invested $317 million in the research and development of NuScale’s SMR project.

NuScale is not alone in developing miniature reactors. In Russia, the government has launched a floating 70-megawatt reactor in the Arctic Ocean. China announced plans in 2016 to build its own state-funded floating SMR design. Three Canadian provinces—Ontario, New Brunswick, and Saskatchewan—have signed a memorandum to look into the development and deployment of small modular reactors. And the Rolls-Royce Consortium in the United Kingdom is working on the development of a 440-megawatt SMR.

Proponents say the time is ripe for this new wave of nuclear reactors for several reasons. First, they maintain that if the global community has any hope of slashing CO2 emissions by mid-century, new nuclear technologies must be in the mix. Second, traditional nuclear power is beset with problems. Many existing plants are aging, and new nuclear power construction is plagued by substantial delays and huge cost overruns; large-scale nuclear power plants can cost more than $10 billion. Finally, advocates say that as supplies of renewable energy grow, small modular reactors can better handle the variable nature of wind and solar power as SMRs are easier to turn on and leave running.

Critics of nuclear power, however, contend that small modular reactors suffer from many of the same problems as large reactors, most notably safety issues and the unresolved problem of what to do with long-lived radioactive waste. And opponents say that even in a smaller form, nuclear power is expensive—it’s one of the costliest forms of energy, requiring substantial government subsidies to build and run, not to mention insure. NuScale’s SMR is offering an artificial 6.5 cent-per-kilowatt-hour cap as an incentive to get its first project off the ground. Yet in September, the Los Angeles Department of Water and Power announced that it had accepted a bid of electricity coming from renewables, with storage capacity that can deliver round-the-clock supply, at 2 cents a kilowatt-hour.

M.V. Ramana, the Simons Chair in Disarmament, Global and Human Security at the University of British Columbia, says that as renewable prices plummet, nuclear power just can’t compete. More than a third of US nuclear plants are now unprofitable or scheduled to close. Globally, nuclear energy now only supplies 11 percent of electricity, down from a record high of 17.6 percent in 1996. After the 2011 Fukushima disaster in Japan, Germany decided to close its nuclear industry altogether, and countries like Belgium, Switzerland, and Italy have declined to replace existing reactors or move forward with plans for new ones.

An artist’s rendering of the small module reactor being developed by the Rolls-Royce Consortium.

Rolls-Royce

But companies and scientists backing the development of small modular reactors say the technology offers a new way forward for nuclear power, one that overcomes many of the drawbacks of traditional, larger reactors. SMRs are much less likely to overheat, the proponents say, in part because their small cores produce far less heat than the cores in large reactors. Innovative designs in SMR technology can also reduce other engineering risks, like coolant pumps failing. NuScale says its SMR has far fewer moving parts than traditional reactors, lowering the likelihood of failures that could cause an accident.

Building smaller reactors also allows them to be mass-manufactured at a central facility and transported more easily, making it possible to install SMRs in remote locations where a conventional reactor isn’t feasible. (SMRs are generally designed to produce 50 to 300 megawatts of electricity, compared to the typical 1,000 megawatts of traditional large-scale reactors.) Perhaps most importantly, proponents argue that SMRs cost much less and can be built more quickly than large nuclear reactors, opening up new markets in the developing world.

“We are about as safe and simple as you can get,” says NuScale co-founder and chief technology officer José Reyes.

Making reactors smaller isn’t a new idea; in fact, the first civilian SMR was commissioned as early as 1955. It was built in Elk River, Minnesota, overran its budget by $9.8 million, and operated only three-and-a-half years before cracks appeared in its cooling system. Since then, commercial reactor sizes have only grown.

In 2000, the Department of Energy funded a project at Oregon State University, among others, to study a multi-application small light water reactor. In 2007, the university granted NuScale exclusive rights to the design of SMR, as well as the continued use of their test facility. In 2011, Fluor Corporation, a multinational engineering firm, invested in the company. In 2018, the US Nuclear Regulatory Commission approved the first phase of review for the design. NuScale now has more than 529 patents granted or pending and close to 400 employees.

Many of the SMR designs in development simply shrink the systems of large-scale nuclear plants, using less fuel. NuScale’s reactor will be just 76 feet high. More than 125 NuScale reactors could be put in a traditional reactor’s containment building, though the company plans to deploy them in groups of 12.

NuScale’s system is also integral, meaning the fuel, steam, and generator will all be in one vessel. “This reduces the risk of accidents because there are less pipes to break,” says Reyes, the company’s co-founder. The technology also uses the core’s heat to drive the coolant flow, eliminating the need for coolant pumps and moving parts that could fail. Each reactor will be self-contained, with multiple reactors sharing a cooling pool.

If a traditional nuclear reactor’s cooling water is lost, its fission can increase, running away until it explodes, as happened in 1986 at Chernobyl in Ukraine. Even after a reactor is turned off, heat from the radioactive decay of fission can melt cores, as occurred in the Fukushima Daiichi nuclear disaster, when a tsunami damaged the generators pumping water through the shut-down reactors. That’s why NuScale engineers have also built relief valves on the reactor vessel, which open when power is lost and release steam into the vessel, where it condenses, recirculates, and provides cooling. Without the need for pumps, Reyes says, “Even under worst case scenarios, where we lose all off-site power, the reactor will safely automatically shut down and remain cool for an unlimited time.” He adds, “This is the first time that’s been done” for commercial nuclear power.

In 2015, the Utah Associated Municipal Power Systems, a utility that provides power throughout six states in the West, agreed to build the first NuScale reactor. With financial support from the Department of Energy, the utility has selected a site within the department’s Idaho National Laboratory, near Idaho Falls, Idaho. “The process is very long, very tedious, and very expensive,” says Ross Snuggerud, NuScale’s chief of engineering operations. “There’s a $1.4 billion barrier to getting the design approved that the government’s created.” Still, Reyes says the company plans to have the reactors operational by 2027.

In Derby, England, the Rolls-Royce Consortium is working on another SMR design—this one for a 440-megawatt reactor, slightly outside the range usually considered small, although Rolls-Royce believes it is the “sweet spot” for achieving economies of scale. The consortium plans to deploy its SMRs on former industrial sites, perhaps even on the grounds of shuttered large-scale nuclear power stations. The design is still in early phases, with Rolls-Royce saying that operation of its reactor is at least a decade away. To date, Rolls-Royce has received £18 million from the British government, and is requesting £200 million more.

Despite the financial and regulatory hurdles, both Rolls-Royce and NuScale anticipate a large market, including selling reactors to African and South American countries, where less robust grid systems might not support the energy load of traditional large-scale reactors. Even in developed countries, SMRs might provide the ability to generate electricity in new places. Canada, for instance, recently announced a plan to explore potential SMR sites in remote locations in the far North that currently rely on diesel to generate electricity.

Another way to make SMRs profitable may be to use them not just to generate electricity for the grid, but to develop advanced reactors that can also produce hydrogen or desalinate water. NuScale says that using excess energy for desalination may be a lucrative market, helping offset desalination’s comparatively high electricity costs.

SMR opponents maintain that no matter the size, nuclear power has unresolved cost and safety concerns. To realize savings through mass manufacturing, there would need to be a standardized SMR design, critics say; currently, there are dozens. And SMRs would also have to be built in large quantities. But for a company to invest in making reactors and their components, it would need a reliable market, and many private investors are still wary of the new technology. Andrew Storer, CEO of the Nuclear Advanced Manufacturing Research Center, which forecasts markets for nuclear power manufacturers, says, as far far as supply chain companies go, “We’re advising people, ‘Don’t invest yet.’”

Recent experience supports skepticism. Westinghouse worked on an SMR design for a decade before giving up in 2014. Massachusetts-based Transatomic Power, a nuclear technology firm, walked away from a molten salt SMR in 2018, and despite an $111 million dollar infusion from the US government, a SMR design from Babcock & Wilcox, an advanced energy developer, folded in 2017. While the Russians have managed to get their state-funded SMR floating, its construction costs ran over estimates by four times, and its energy will cost about four times more than current US nuclear costs.

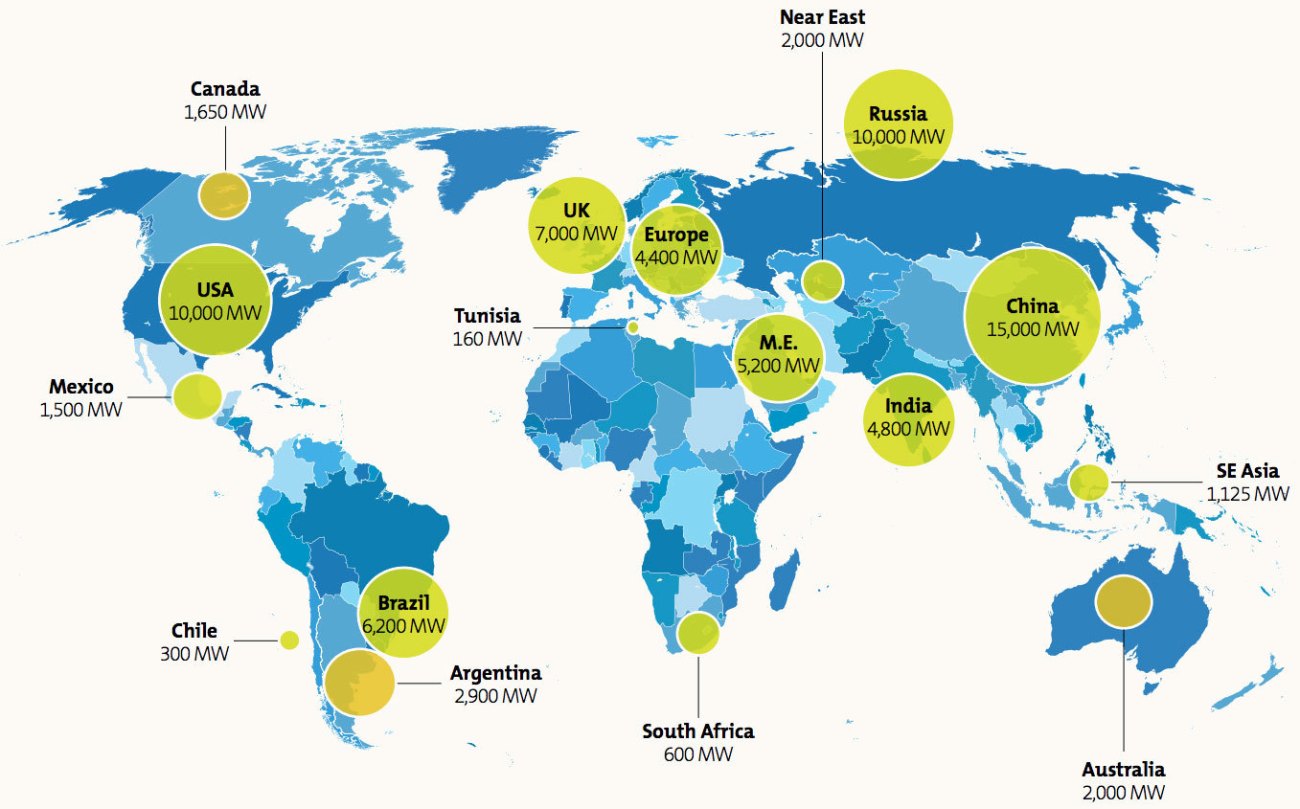

The potential global SMR market (in megawatts), according to an analysis by a British consortium.

National Nuclear Laboratory/Rolls-Royce

Eventually, every nuclear conversation turns to radioactive waste and safety. SMRs using a pressurized water reactor will continue to generate highly radioactive spent fuel, yet no country has a permanent solution for how to safely store this kind of waste. The US has been looking for a place to put a permanent nuclear waste repository since 1982; in the meantime, 70 percent of the US’s spent fuel is sitting in cooling pools, many of which are aging and vulnerable, and often in quantities much larger than what is considered safe.

Because NuScale hopes to replace coal-fired power plants in the US and the UK, perhaps even building on the grounds of shuttered power plant sites in more populated areas, the Nuclear Regulatory Commission is considering eliminating some standard safety measures, including a requirement for an emergency evacuation zone and the need for backup power. NuScale says that because SMRs contain smaller quantities of radioactive materials and can be sited underground, their risks are lower and they require less security staff.

This has raised sharp criticism from nuclear experts. Even the Union of Concerned Scientists, which has generally supported nuclear power, says, “It would be irresponsible for the NRC to reduce safety and security requirements for any reactor of any size.”

The one thing everyone seems to agree on is that the need for new, carbon-free energy is urgent.

Nuclear proponents have argued net-zero emissions will be impossible to achieve fast enough without relying on nuclear energy. But there’s no consensus in energy policy that this is true: Renewable energy has expanded faster than expected, and as energy storage technology continues to improve, its potential is only growing.

“What really needs to happen at this point is for there to be competition among low-carbon energy sources, to see who can deliver the most benefit for carbon reduction at the least cost,” says Peter Bradford, a former member of the Nuclear Regulatory Commission. “I don’t have a problem with the government underwriting research in a different energy technology, as long as the research is proportional to the promise it has shown.”