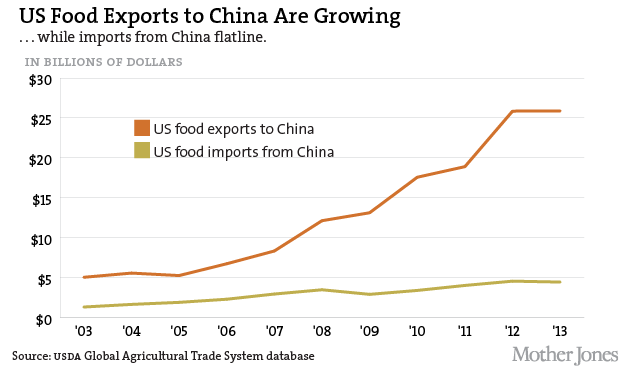

We hear a lot about the perils of consuming food from China—and very little about the food we send to China. Yet we export five times more chow to China than we import from it (see chart above).

No doubt, China has undergone a full-on food-production miracle over the past generation, but there’s zero chance that its farms will emerge as a global exporting powerhouse, as its vaunted electronics factories have done. As this 2013 UN report notes, China’s total farm output has tripled since 1978. But it has to feed nearly a fifth of the globe’s people on just 8 percent of its arable land. Meanwhile, nearly 20 percent of China’s farmland has been polluted by runoff from industrial waste and/or excessive agrichemicals, its government recently acknowledged. On top of that, the country’s water resources are extremely limited.

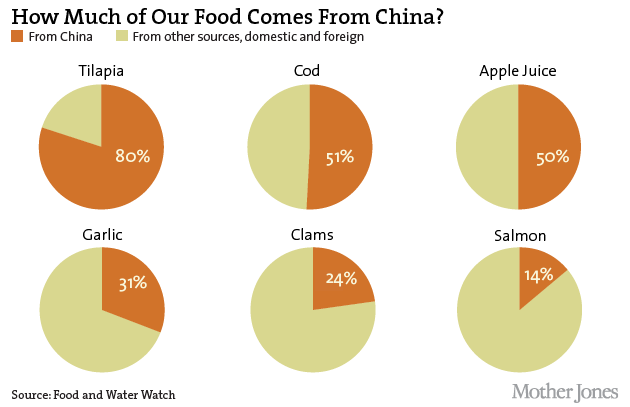

Nevertheless, China is a major supplier of some high-profile items in our grocery stores and restaurants. Which ones?

Overall, though, China is a relatively minor source of food for the US—we import much more from both Mexico and Canada. The much bigger story is rocketing exports. China overtook Mexico as the country that sucks in the most US food in 2012. We export more than $25 billion worth of food per year to China, as the chart at the top shows—an amount nearly equal to total annual food expenditures in the state of Ohio.

The main driver: China’s rapid switch to a US-style meat-rich diet. China taps US farms to feed its fast-growing meat habit in two ways. First, it directly imports it. Pork exports to China have surged over the past decade. China is also a large importer of beef on the global market (mainly from Australia), but it has banned US product since 2003, over a mad-cow disease scare. With its beef demand soaring, though, it recently signaled it might lift the beef ban as early as July. As for chicken, China imports a huge amount from the US; and it has also invited US agribusiness giants Tyson and Cargill to plunk down chicken farms on domestic soil. These factory-scale facilities need a steady supply of feed to keep humming—and that’s where we get to the second way China looks to the US for its meat supply: by importing lots and lots of livestock feed, namely, corn, soybeans, and alfalfa (fed as hay to cows). Chinese consumers are also demonstrating a surging appetite for another protein-rich US product: nuts, almost all of which are grown in California. And, perhaps to help wash down all of that meat, there’s a growing thirst for another California-centric luxury product, wine.

These final charts, drawn from recent USDA projections, suggest that China’s love affair with meat will continue. Meanwhile, its appetite for nuts shows no sign of abating. For the US, these trends no doubt mean a windfall for the agribusiness companies that dominate meat, grain, and nut production. They also mean yet more pressure on our two most important food-growing regions: California’s Central Valley and the Midwest’s corn belt. As I’ve pointed out before, the Central Valley, source not only of nuts but also of alfalfa, is already rapidly drawing down fossil water resources to irrigate its drought-parched farms; and the corn belt is quietly undergoing a potentially devastating loss of topsoil, under the strain of maximum production and chaotic weather.