The 2009 stimulus bill included a tax cut called the Making Work Pay tax credit. Bruce Bartlett writes about what happened last year, when it was set to expire:

At the end of 2010, all of the tax cuts enacted during the George W. Bush administration were scheduled to expire, as well as the Making Work Pay credit. Although President Obama wanted the tax cuts for the rich to expire on schedule, Republicans insisted on an all-or-nothing strategy. Republicans also asked that the Making Work Pay credit be replaced by a temporary two-percentage-point cut in the employees’ share of the payroll tax.

….In short, the payroll tax cut was a Republican initiative. So why did they turn against it? The answer is unclear.

Unclear? Let’s roll the tape:

- 2009: Obama favored the Making Work Pay tax credit. Republicans were opposed.

-

2010: Obama wanted to keep the MWP and initially

opposed the payroll tax cut. Republicans supported it.

opposed the payroll tax cut. Republicans supported it. - 2011: Obama is in favor of extending the payroll tax cut. Republicans are now opposed.

Do you see the trend? Sure you do.

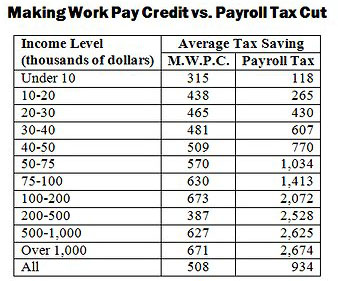

Also of note: Bruce includes a chart from the Tax Policy Center showing why Republicans wanted to replace the MWP with a payroll tax cut in the first place. Partly to annoy Obama, of course, but it turns out that the payroll tax cut is far friendlier to rich people than the MWP. The absolute dollar amounts are small enough to be a rounding error for the truly wealthy, but I guess it’s the principle that counts.