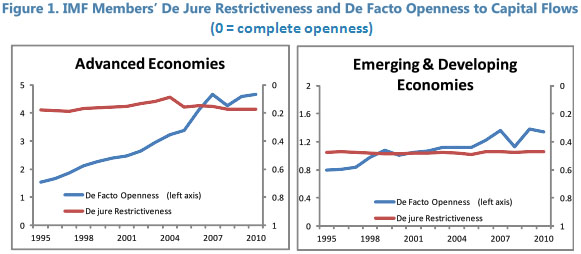

The IMF has now officially come around to the belief that capital controls—limits on the global flow of money—are sometimes appropriate, especially for small, volatile, emerging economies. But not only for small, volatile, emerging economies:

19. Indeed, as the recent global financial crisis has shown, large and volatile capital flows can pose risks even for countries that have long been open and drawn benefits from capital flows and that have highly developed financial markets. For example, in several advanced economies, financial supervision and regulation failed to prevent unsustainable asset bubbles and booms in domestic demand from developing that were partly fueled by cheap external financing. Rather than favoring closed capital accounts, these experiences highlight the need for policymakers to remain vigilant to the risks. In particular, there is a constant need for sound prudential frameworks to manage the risks that capital inflows can give rise to, which may be exacerbated by financial innovation.

I’m glad to see this. I’m not an economist, which means that my views are crude and unlettered. But one of the things I’ve taken away from the past decade is a general belief that an increasingly frictionless global financial system is a bad thing, even for supposedly advanced, sophisticated countries like us. Roughly speaking, that means I think there ought to be a little bit of sand in the gears to slow things down. Modest capital controls can play a role in this, as can small financial transaction taxes, higher capital requirements for banks, and stronger tax treatment of debt. By analogy, we want highways that can whisk you along to your destination at high speeds, but we also understand that when speeds get too high the risk of danger rises exponentially. Right now, the speed limit on our financial highways is about the equivalent of a hundred miles per hour. Getting it down to 70 or 80 would probably be a good idea.