A few days ago I praised Sen. Jeff Flake for publicly slamming President Trump, and then suggested that there was little more that conservative politicians could do. There’s no reason to expect conservatives to vote against conservative bills just because Trump happens to like them, after all.

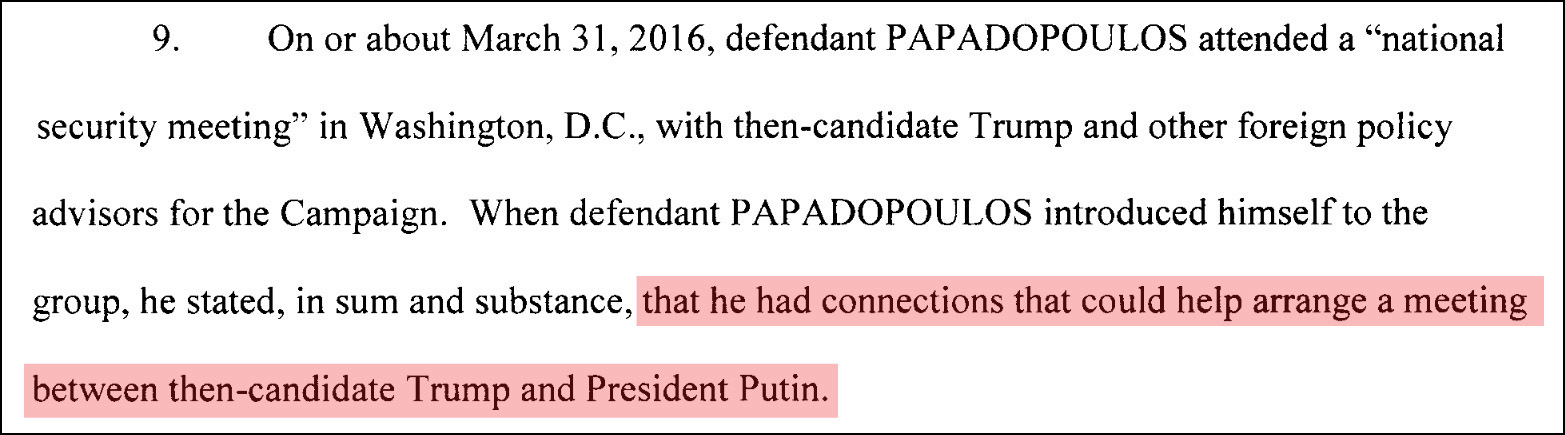

Three conservative House Republicans are expected to file a resolution Friday calling on special counsel Robert S. Mueller III to recuse himself from his probe of Russian meddling in the 2016 U.S. presidential election, accusing him of conflicts of interest. Rep. Matt Gaetz (R-Fla.), who wrote the resolution, accuses Mueller of having a conflict of interest because he was serving as FBI chief when the Obama administration approved a deal allowing a Russian company to purchase a Canada-based mining group with uranium operations in the United States, according to a draft obtained by The Washington Post.

This is about what we’ve come to expect from the ultras in the House, but it’s not going to stop with them. Fox News will jump on board; the Wall Street Journal editorial page will nod wisely; Trump will toss out a barrage of tweets; and momentum will build. So here’s something the Flakes and Corkers of the world can do: introduce legislation making it clear that Trump better not interfere with Mueller—and writing language that will make it impossible for him to do so. Even if Trump vetoes it, it sends a strong message that the rule of law matters more than Donald Trump’s address.