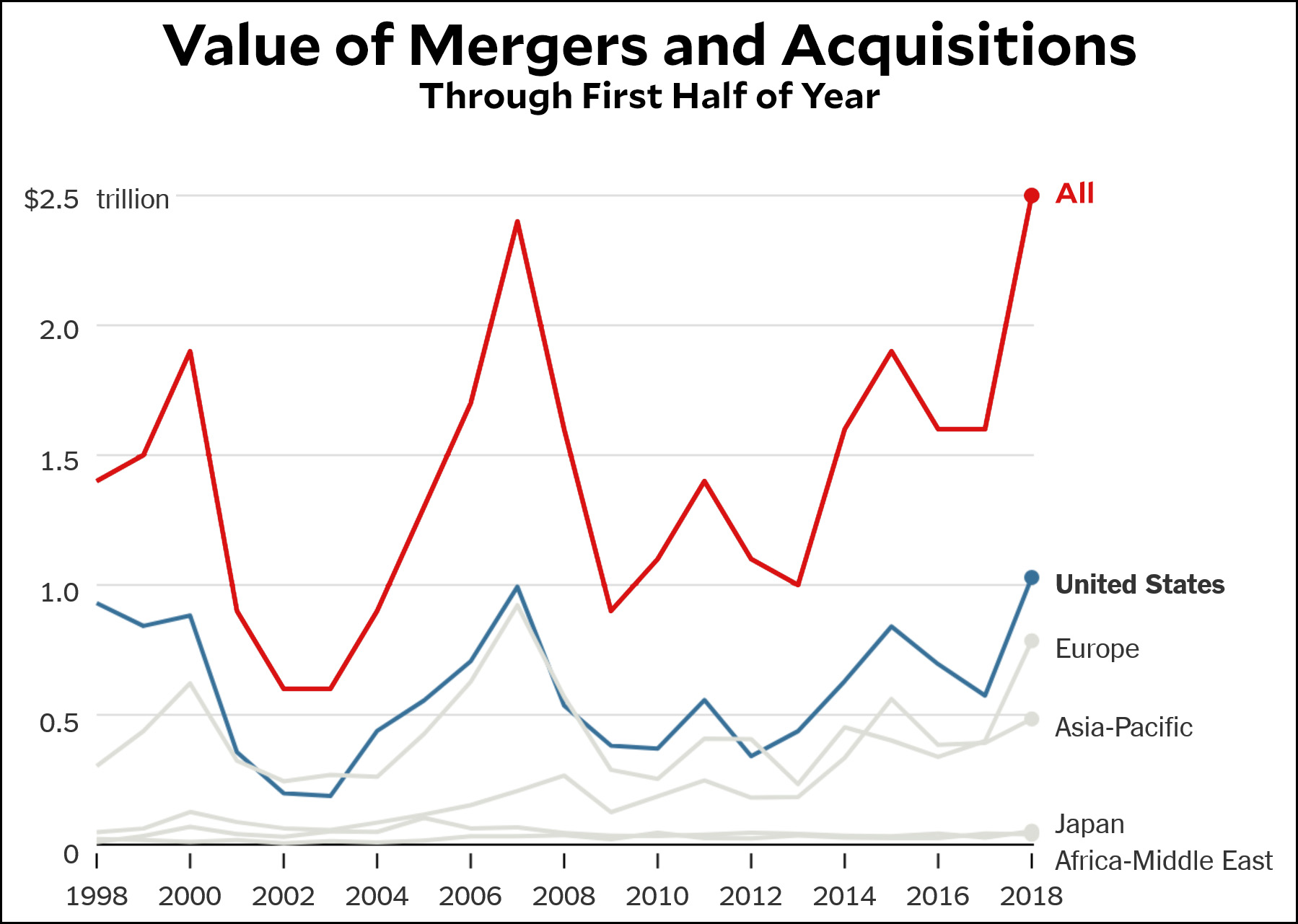

The New York Times has tallied all the corporate merger activity through the first half of the year and compared it to first-half activity over the past two decades:

We’ve set a new record, surpassing even the insane bubble year of 2007. Or have we?

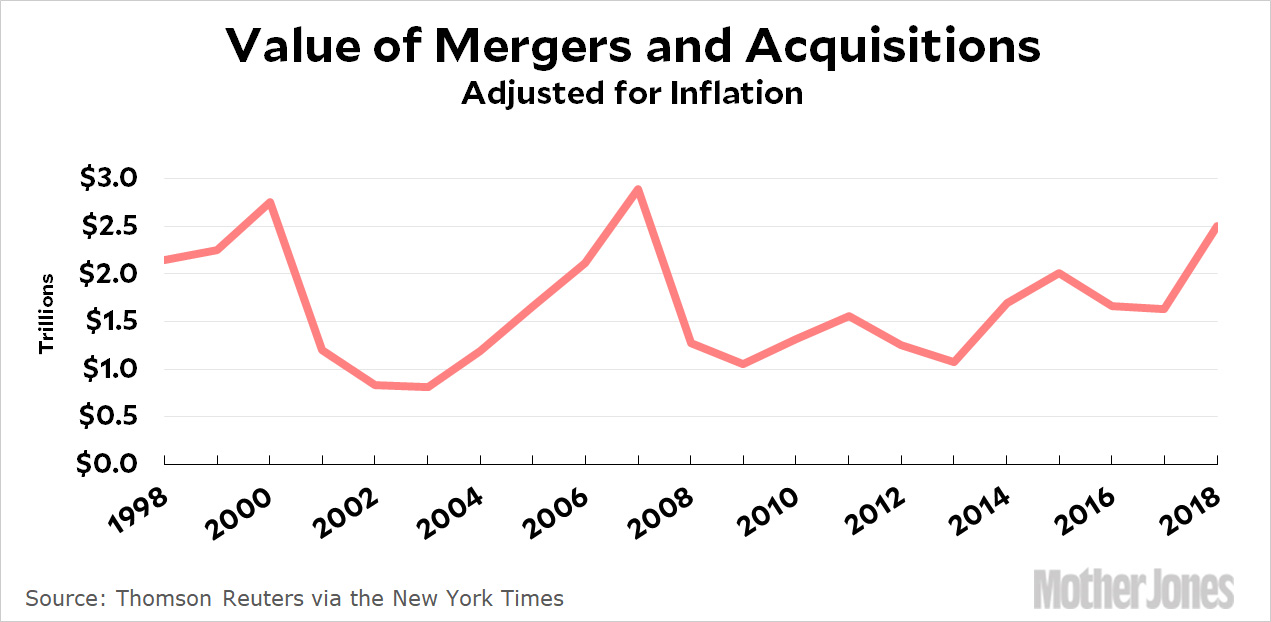

As always, these comparisons over time need to be adjusted for inflation. M&A activity is certainly looking frothy, but it’s not record-setting. Not yet, anyway. But if it continues to rise at the current rate, it will be next year.

Big corporations are earning record profits and have just gotten a huge tax cut. Unfortunately, they still seem to be spending their money mostly on stock buybacks and defensive mergers. This is not what we’d see if they were truly bullish on long-term growth prospects.