Here’s an interesting chart from a research paper flagged by a reader. It turns out there’s a Chicago futures market for weather, mostly used by utilities and growers to hedge against the possibility of unusually high or low temperatures. However, since weather forecasts are nearly useless more than ten days out, futures contracts purchased earlier than that are based almost entirely on broad climate forecasts.

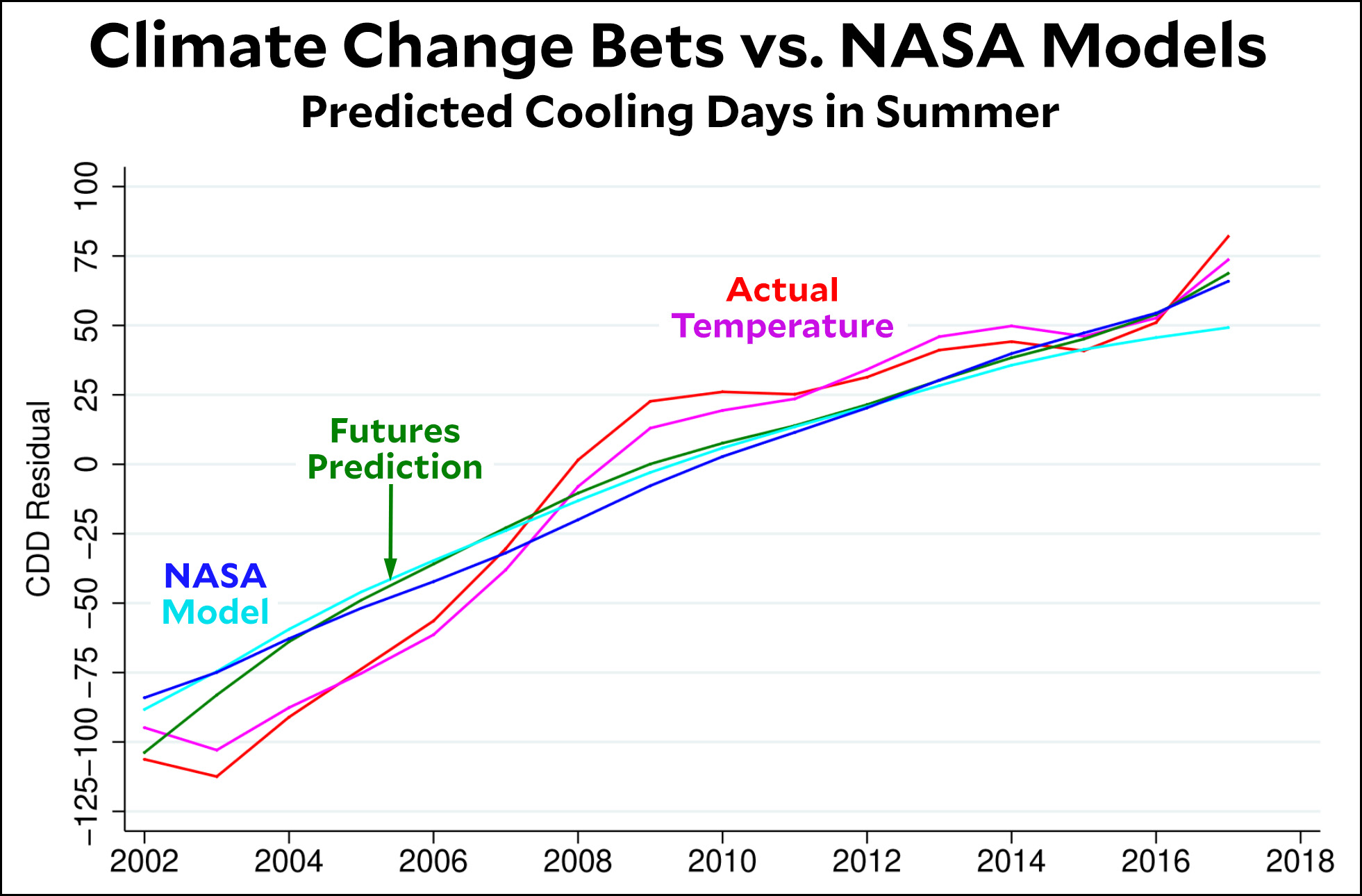

Climate scientists, of course, have been predicting global warming trends for quite a while. So how do their models compare to the predictions made by people who have to put their money where their mouths are? Pretty closely, it turns out. Here, for example, is the predicted number of “cooling days” (i.e., hot days that will require cooling) during the summer for the past couple of decades:

The light and dark blue lines are the two most widely used NASA climate models. The green line shows the equivalent projection based on the futures market. Guess what? When money folks have to hedge the weather, it turns out they listen to climate scientists. Their projections closely match the predictions made by climate models.

When Republican senators make fools of themselves pretending that climate change is fake, they know there are no consequences for being wrong.¹ Traders don’t have that luxury. What they care about is accurately hedging risk, and the only way to do that is to listen to climate scientists and make their bets based on the real world. So regardless of whether they’re personally liberal or conservative, that’s what they do.

¹No short-term personal consequences, anyway. The possibility of broiling the earth 50 years from now is a whole different thing, but it doesn’t affect their reelection chances so they don’t care.