Album / Metropolitan Museum of Art, NY

The Wall Street Journal catches up today with the lastest fad among Democrats: taxing wealth, not just income. But conservatives aren’t sold:

Many conservatives argue that taxes targeted at the rich could hinder investment in ways that would hurt everyone’s wages and discourage the creation of wealth in the first place. New taxes on wealth would complicate tax administration and bring unknown economic consequences. “It would be incredibly disruptive to markets,” said Sen. John Thune (R., S.D.). “People would start looking for how to game it and ways to shield and shelter.”

Oh dear. Rich people would start looking for ways to game a wealth tax. They’d never do with an income tax, so I guess we’re stuck.

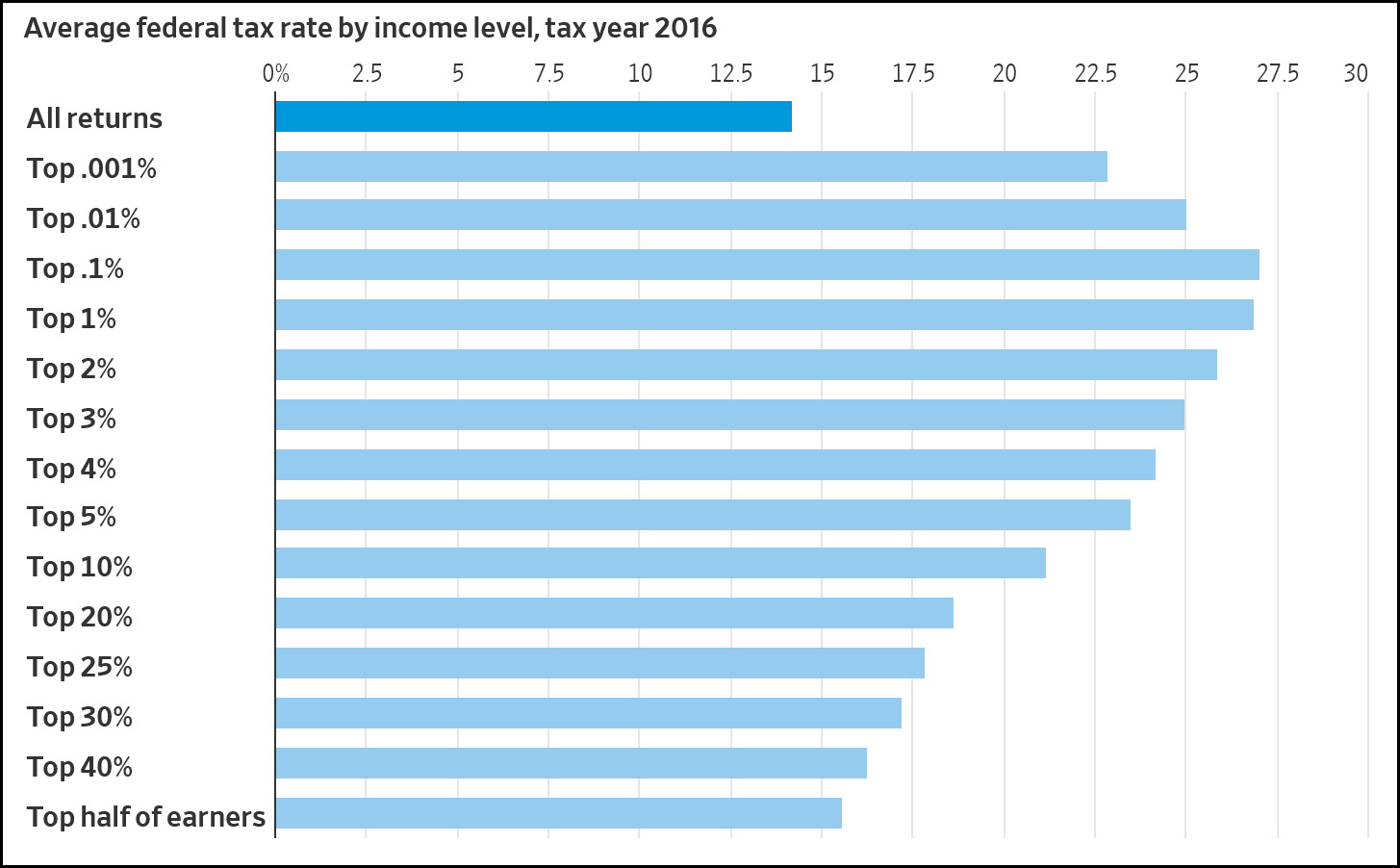

This is as laughable as it sounds, but there is another reason to go slowly on this. The Journal presents this chart of income tax payments:

Just for starters we could keep the income tax progressive for the super-rich. If effective rates kept going up, with the top .001 percent paying around 35 percent, that would take a chunk out of wealth all by itself. That’s the place to start. Beyond that we could raise rates on capital gains taxes, which is paid almost exculsively by the wealthy, and perhaps treat Social Security taxes like Medicare taxes, which apply to all income instead of only income up to a certain limit.

Assuming you have the political will to do it in the first place, these are all quick and easy changes that are well understood and easy to implement. They don’t require complicated definitions and they don’t require an entirely new enforcement arm of the IRS. And they’d raise loads of money.

If it’s not enough, maybe a progressive VAT? That would put us on a level playing field with most other advanced economies.

By the time we were done with all that we’d probably be taxing something between 40-50 percent of all income, which is as much as any country in the world takes in. There’s really no need to look around for funky alternatives when everything we need to tax the rich and fund our lefty dreams is right in front of us.