A few days ago President Trump said he was “seriously considering” a cut in the capital gains rate if he’s re-elected. Needless to say, Trump says a lot of things, and the fact that he said this probably doesn’t mean much. Still, he was backed up by longtime capital gains warrior Larry Kudlow, who told reporters “We’d like to take it back to 15%, where it was for quite a long time because it helps jobs, investment, productivity and wages.”

Is that true? First off, here’s the amateur view of whether capital gains rates have any effect on economic growth:

Hmmm. It sure doesn’t look like the capital gains rate has much correlation with real GDP growth. If anything, the trend lines are going in the wrong direction entirely: capital gains rates have been declining since 1960, but the only result has been a decline in GDP growth too. If low capital gains rates boost GDP, it sure doesn’t show up here.

But this is just playground stuff. Serious economists have far more sophisticated ways of figuring out if capital gains cuts lead to higher economic growth. So what do they say?

- A Congressional Research Service report written in 2012 concludes that “neither the top marginal tax rate nor the top capital gains tax rate are strongly correlated with saving, investment, labor productivity, and GDP growth controlling for other covariates.”

- Tax expert Joel Slemrod says “there is no evidence that links aggregate economic performance to capital gains tax rates.”

- A policy brief from the Levy Economics Institute finds “little theoretical or empirical basis for the view that lowering the capital gains tax rate would have a substantial effect on economic growth or level of economic activity.”

- The Penn Wharton Budget Model calculates that an increase in the capital gains rate would have no negative effect on economic growth.

- A pair of researchers at the University of Groningen looked at capital gains rates worldwide and concluded that “Using a long cross-country panel data set going back to 1965 and employing a variety of econometric techniques, we document that greater reliance on capital taxation, measured in different ways, is not negatively associated with growth rates.”

I could go on, but why bother? There’s been a ton of research on this subject and it almost unanimously concludes that capital gains rates have a tiny effect at most on economic growth. On the other hand, when capital gains rates are different from ordinary tax rates they can cause serious mischief:

- As Len Burman says, “Virtually every individual income tax shelter is devoted to converting fully taxed income into capital gains.”

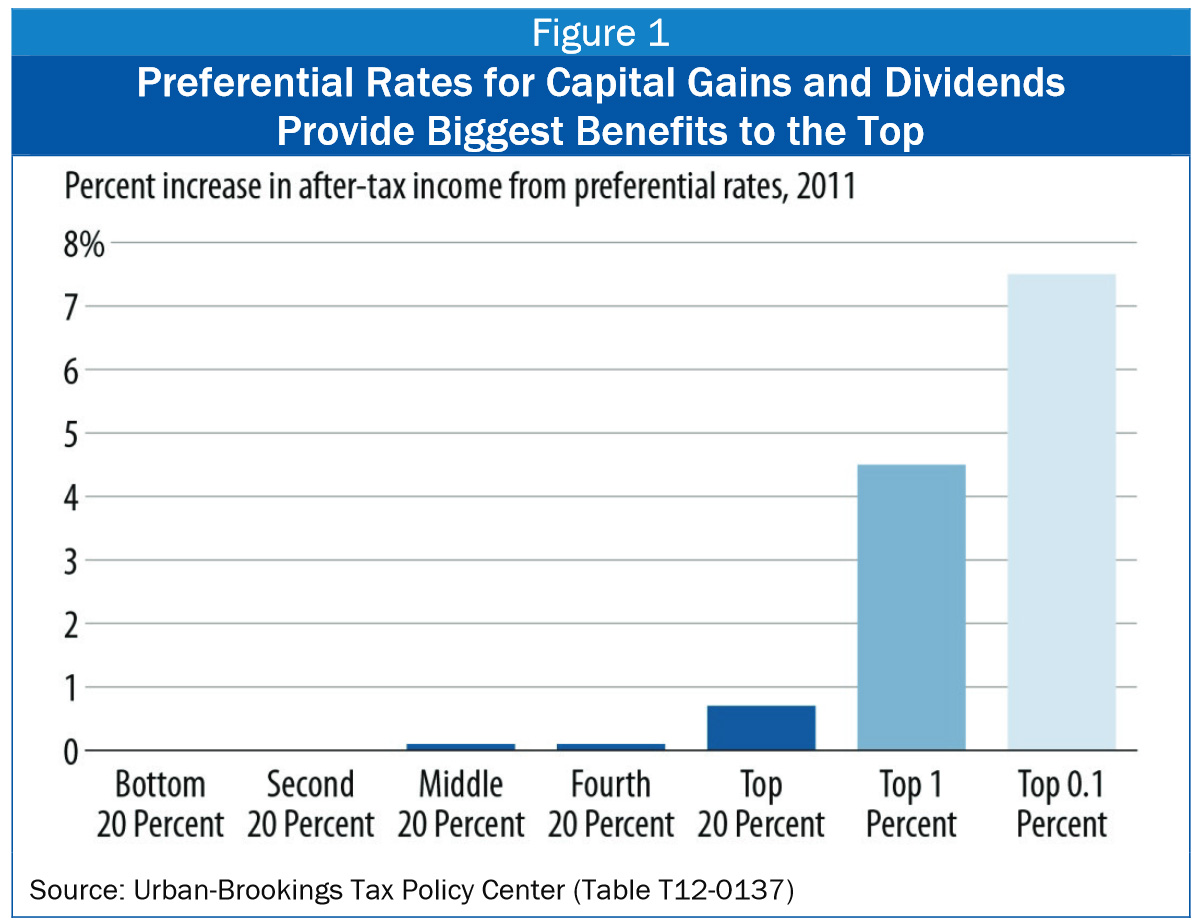

- Capital gains tax cuts are regressive, with the benefits going almost exclusively to the rich. The Tax Policy Center estimates that 71 percent of the benefits go to the top one percent.

- Many affluent households earn a majority of their income in capital gains. This means that some of them actually have lower overall tax rates than middle-class households, who have to pay the ordinary income tax rate. Lowering the capital gains rate would only make this worse.

So that’s that. It’s no surprise that rich people—and therefore the Republican Party—are in favor of reducing capital gains rates. Why wouldn’t they be? But there’s no reason for the other 99 percent of us to be in favor. It does the economy no good; it does us no good; and it motivates lots of inefficient gameplaying with taxes. It’s just another stupid con. Don’t fall for it if your income is anywhere below $200,000 or so.