Illustration: Asaf Hanuka

LIKE MOST PEOPLE whose quality of life depends upon the fluctuations of an IRA, 401(k), 403(b), or other acronym-soup retirement account, I was born long before such things existed. It’s easy to forget, now that more than half of us have been made shareholders, that until well past the middle of the 20th century, most people had nothing to do with the stock market: Wall Street was for the wealthy and the reckless. It was a world most Americans didn’t understand and, after 1929, didn’t trust. Some lucky people had pensions, but few had the privilege of even thinking about retirement. They were too busy trying to survive the present—which in my childhood meant the Great Depression and then World War II.

I spent the war years in Washington, DC, where my father had a minor position in the Roosevelt administration. After school, my brother and I spent most of our time running around the streets, trying to get the air-raid wardens to give us a scrap of nylon parachute, or maybe even one of their cast-off World War I helmets, before the blackout drill began. One evening, my mother called us into the dining room and solemnly presented each of us with a $25 war bond. That was my first contact with the world of investment. Compared to a piece of parachute, it was a real downer.

Sixty-five years later it’s a downer still, as I contemplate my future at a time of deep recession with no pension and a depleted 401(k). And it occurs to me that the very notion of a comfortable, paid retirement may turn out to have been a temporary phenomenon, with a life span almost precisely the same as my own.

The United States instituted military pensions after the Civil War, but German chancellor Otto von Bismarck is generally credited with creating the first national pension system, in the late 1880s, partly to combat the growing appeal of Marxism. Since Bismarck’s pensions kicked in at 70, and the average life expectancy in Germany at the time was under 45, it wasn’t much of an investment on the part of the state. In fact, until about World War II, a majority of people died before they reached what we now think of as retirement age; those who made it to 65 depended on savings or relatives, or went to the poorhouse.

The truly pivotal moment in the history of paid retirement came in the year before my birth, 1935, which saw the passage of the Social Security Act (again, in part to ward off more radical proposals). This system lifted millions of the elderly out of poverty, though it would never, by itself, provide a comfortable living. That came with the rise of employer-funded pensions, which were fought for by unions in the early part of the century and expanded during World War II, when they became a way to reward workers during government-mandated wage freezes. Suddenly, retirement became a possibility for millions of American workers.

These workers had “defined benefit” plans, which promised a steady monthly payment at retirement. Although a portion of the pension funds might be invested in the stock market, the payout to workers didn’t depend on the market’s fluctuations.

After the war, my father joined IBM and remained there for about 15 years. I remember that he was constantly in debt from paying our college tuitions and medical bills for his ailing parents. He never talked about it, but every so often, I would see a line of bills from credit companies spread out on the bed. He had a fierce dislike of Wall Street and the banking industry, formed during the Depression and abetted now by his high-interest debts. Although he had a three-hour round-trip commute on the New York Central Railroad every day from our home in a then-unfashionable part of the Hudson Valley, he often remarked how grateful he was that he didn’t have to ride the New Haven trains with all the cocktail-wielding brokers. Even if he’d had any money to spare, he wouldn’t have invested it on Wall Street. But when he retired, he got his pension, which my mother continued to collect after he died—not much, but enough to live on in a frugal way.

I WAS PLUNGED into the world of finance when I got my first job, at the Wall Street Journal, at the beginning of the 1960s. They put me to work writing up corporate bonds, especially new public offerings, on the Dow Jones ticker. Every time there was a bond sale, I would call up the manager of the syndicate of investment banks selling the securities to find out what had happened. He would invariably say, “Oversubscribed, and the books closed,” which would be duly noted, along with the selling price, on the ticker. The bonds were always quickly snapped up by institutional investors and others in the know. I had only the thinnest understanding of how any of this worked, but I dutifully wrote everything down, and no one seemed to complain.

The first ordinary person I met who regularly invested in the stock market was a guy I’ll call Frankie, who was in my National Guard unit. While working at the Journal, I was still satisfying my Guard service requirement with two-week summer stints as a truck and jeep driver, upstate at Camp Drum, along with periodic training sessions at the armory on Lexington Avenue. I use the term “training session” loosely: The Fighting 69th has a robust record of combat stretching back to the Civil War, but in those days, we spent a good deal of our time on the armory roof, smoking, drinking beer, and listening to Frankie recount his days driving rich people around at his job at the Jaguar showroom uptown. Frankie always had tips that he’d picked up from his well-to-do customers. The next morning we would rush out to a broker and put down $100 on some obscure stock that, according to Frankie’s sources, was all set to skyrocket. I remember watching the newspapers as one of our stocks held steady and then, right on schedule, began to rise—from $7 a share to $8 to $8.50. We rubbed our hands in expectation of the proceeds that would soon be raining down on us, delighted that through Frankie we had tapped into the magic circle of rich people who got even richer by playing the stock market. Then our stock dropped overnight, to $2 a share. On the roof the following week, Frankie was sheepish and apologetic, but unperturbed. The market went up and the market went down, he shrugged. To make money you had to stick it out. He promised to get us a new and better tip from the Jaguar buyers.

At the Journal, meanwhile, I was moved to the banking section, where I was assigned to cover mutual funds—something I’d never heard of before coming to the paper. Instead of buying shares of this or that stock, a mutual fund would bundle up a number of investments: blue-chip companies, or technology stocks, or low-priced securities that amounted to little more than fliers in high-risk markets. The mix within the fund, and its return, was the handiwork of supposedly astute advisers whose fortunes rose and fell depending on how their funds performed.

Although the first modern mutual fund was founded in the 1920s, they were rare until the postwar period and still didn’t account for much in the early 1960s. At the time I was given the mutual fund beat, it was scorned by the other, more upwardly mobile reporters. As John Bogle, legendary founder of the Vanguard Group of funds, reminded me in a recent interview, the prevailing attitude was that mutual funds were for people “too dumb to do anything else”—those who didn’t have the sophistication to deal in individual securities. But the old guard of Wall Street—well-bred WASPs and German Jews who viewed the whole financial world as an insiders’ club—was being challenged by new firms coming into the over-the-counter market, many of them run by upstart kids from immigrant families. Some of these less hidebound denizens of the Street saw mutual funds for what they were: an opportunity to take advantage of the postwar boom and bring a flood of new, middle-class investors into the market.

I dutifully began going to mutual fund meetings, usually held at swank downtown men’s clubs. There was always plenty of whiskey, high-class hors d’oeuvres, and sexy women handing out quarterly reports. Afterward, we would stagger back to our papers and write up a paragraph or two. Then, unexpectedly, I got a real story. An editor at the Journal had heard about a series of stockholder suits accusing some big mutual funds of ripping off consumers through a series of hidden fees, all appearing to come from different companies—investment advisers, sales outfits, management concerns—when in fact all were part of an interlocking network.

Fees have always been one of the built-in scams of mutual funds, which charge investors for managing, operating, and even marketing and advertising the fund. On average, the fees add up to 1.5 percent of the value of an account, but they can run as high as 3.5 percent a year. This means that a fund showing a 7 percent gross return has a net return to investors of 3.5 percent after taking into account the 3.5 percent fee. As Rep. George Miller (D-Calif.), chairman of the House Committee on Education and Labor, put it during a February hearing on retirement security, “Wall Street middlemen live off the billions they generate from 401(k)s by imposing hidden and excessive fees that swallow up workers’ money. Over a lifetime of work, these hidden fees can take an enormous bite out of workers’ accounts.”

Congress, of course, has known about this scandal for years, and has periodically floated legislation to limit certain types of mutual fund fees, or at least demand full disclosure. Committees have held hearings, the Government Accountability Office has produced studies, and the Securities and Exchange Commission (SEC) has paid a good deal of lip service to the matter. But in the more than four decades since those first stockholder suits, through Republican and Democratic administrations alike, no meaningful changes have been made. Instead, the most significant challenge to the mutual fund fee rip-off has come from inside the industry, through John Bogle’s invention of the index fund.

Bogle’s Vanguard funds gave the lie to the fee scam by replacing the vaunted genius of the mutual fund manager with a computer that constantly evaluates the value and trajectory of different funds; his average fees are 20 percent of the industry average. (In the same spirit, the Chicago Sun-Times has in recent years had a monkey picking stocks. The monkey’s four-year streak of beating the market was broken in 2007—but he still managed to outperform some major financial advisers.)

The Journal eventually fired me, and I couldn’t blame them: I didn’t understand mutual funds, and I barely understood stocks, bonds, or banking—save the ever-present dread of a bounced check. So I went to London, where I worked as a waiter in a mod coffee bar in North London to supplement my freelance work for the London Observer. But even there, I couldn’t shake the mutual fund jinx. Right away I was dispatched to Edinburgh to cover the annual meeting of a new mutual fund company. The scene was just like the one in New York, except that the whiskey was older, the girls were younger, and the financial jargon was dished out by smiling Scotsmen whose accent I could barely decipher. Their message, as far as I could make out, was just like the New York executives’, too: Mutual funds were just brilliant because they pooled resources and spread out risk, allowing ordinary lads to partake in the bounty of the market.

On both sides of the Atlantic, mutual funds at this point were promoted as a way to democratize investment. Never mind that what made the funds accessible to the common man and woman—the fact that they mixed together an ever-changing stew of financial instruments and then ladled it out in affordable portions—also made them inscrutable to most investors (and most elected officials as well). No one seemed to know what might be buried in those funds—and no one seemed to care. It was the perfect manifestation of J. Paul Getty’s adage: “Money is like manure. You have to spread it around or it smells.” And mutual funds were about to start really shoveling it—courtesy of the US government.

ON SEPTEMBER 20, 1980, a Philadelphia benefits consultant named Ted Benna discovered an obscure codicil in the tax code known as section 401(k), under which employees would not be taxed on income they chose to receive as “deferred” compensation—money they didn’t use until later. The provision had been passed, without any hearings or public debate, just two years earlier as a favor to bank holding companies—but Benna realized that the wording of the law was not limited to banks. Any company could create a savings account in which employees could sock away a little pretax money every paycheck, money that might or might not be supplemented by the employer.

Some of the early supporters of the 401(k) hoped both to spur personal retirement savings and to encourage companies without any pension plans to start them up; “defined contribution” accounts were also seen as more useful for workers who didn’t stay in one job long enough to accumulate a significant pension benefit. Others no doubt recognized them for what they were: a huge boon to corporate America, which quickly moved to replace costly defined-benefit plans with 401(k)s invested in mutual funds.

Unions were pressured to acquiesce to cuts in benefits, and workers were sold the idea that 401(k)s offered more “choice” and the chance of high returns in the market. For employers it was heaven: The more stock touts prospered, the more they could cut back their own contributions to retirement plans as well as the premiums they paid to the federal Pension Benefit Guaranty Corporation (PBGC). Better yet, they could make their contributions in shares of their own stock and channel employee contributions that way as well—a practice that helped Enron, among others, inflate its stock and left employees high and dry when it collapsed.

It soon became clear that 401(k)s were not going to supplement pensions, but replace them. (See “Scrambled Nest Eggs.”) Congress did its part, raising premiums for defined-benefit plans (which had to contribute to the PBGC) and thus making 401(k)s (which did not) more attractive. As time went on, more and more companies froze their defined-benefit plans, creating a two-tiered system whereby longtime workers got to keep their traditional pensions while new employees were routed into 401(k) plans. In addition to their advantages for employers, 401(k)s favored wealthier workers in higher tax brackets, who stood to benefit more from being able to set aside a portion of their salaries tax free.

No one seemed much bothered by the move of a vast portion of Americans’ retirement funds into risky securities-based funds. The Fed supported the 401(k) boom, just as it later would the housing boom, by championing deregulation and keeping interest rates low. Who would choose to invest their retirement funds in safe but low-interest bonds or T-bills when they could make 10, 15, or 20 percent in the market? In 1983, according to a survey conducted by two securities-industry groups, just 15.9 percent of American households owned equities; by 2005, the figure was 56.9 percent. More than half of households that owned stocks had first gotten into them through a 401(k) or similar account.

I PERSONALLY took part in the 401(k) revolution, though not by choice. Through the 1960s and ’70s, I worked at The New Republic and a couple of small publications I cofounded. By this time I understood a little more about how finance capitalism worked, having read the footnotes to Marx’s Capital—but since I also now had a house and a son and no money to spare, I never faced any moral dilemmas over whether or not to invest for the future via the corrupt free market. By the 1980s, I had landed at the Village Voice, and when the staff formed a union, one of its demands was a pension plan. By then the defined-benefit plans were out of style, and the best we could get was a 401(k) with a small employer contribution.

Like most 401(k) plans, this one was managed by a major financial company, which offered several choices for where we could put our money. For the staid old farts there was the basic fixed-interest-bearing account, eschewed by the knowledgeable high rollers who bet a quarter of their money in growth stocks and a quarter in balanced income, took a flier on small capital start-up companies, and even put a bit of money into some European pharmaceutical company or Asian sweatshop. To me, it all seemed like hedging your bets at the racetrack: Instead of putting money on a single horse, you put it on several, and hoped they would end up at the head of the pack.

At some point, the irritable lady who changed the mix of funds in our 401(k) over the phone gave way to an online system. Now everyone could be his own broker, Las Vegas in your living room. You heard stories of steelworkers turning up on million-dollar yachts in the Caribbean after their plants closed—thanks to their 401(k) winnings. Folk heroes rose out of the mutual fund business, brash young investment advisers who won huge returns, geniuses who ran hedge funds, touting one stock or another. I watched my 401(k) earnings grow, and at some point, I actually began to think that if I were forced out of the journalism business at 65, I might be able to live on the proceeds.

I was far from alone, of course. In 1983, 62 percent of workers relied on a defined- benefit plan; by 2007, only 17 percent did, while 63 percent only had a 401(k) or similar defined-contribution plan. Assets in 401(k)s had jumped from $92 billion in 1984 to $3 trillion. The rise of mutual funds, combined with the ’90s boom and America’s demographic realities, did in fact help to drive the current financial crisis. While common sense told you that there was bound to be a crash—that there simply couldn’t be that large a pool of genuinely secure, high-quality investments with the kinds of yields people had gotten used to in the 1990s—the global economy bought it nonetheless. “Because, you see,” writes MSNBC financial analyst Jim Jubak, “it’s the only way out for an aging world that’s running a huge shortage of the real stuff. So investors were all too willing to buy fake investment-grade paper—at prices commanded by the real investment-grade stuff—until finally the con was revealed.”

Even the mutual fund scandal of 2003—prompted by then-New York attorney general Eliot Spitzer‘s discovery that a number of major funds and investment houses had colluded on buying and selling shares after the close of daily trading, at a high cost to the small-time, long-term investors who had money in 401(k)s—didn’t do much to dampen enthusiasm for the industry. Congress considered some legislation that never passed, the SEC did a bit of impotent saber rattling, Spitzer was defanged by a sex scandal, and investments in mutual funds continued to grow.

Then the crackup began—starting with the speculative-grade instruments so often bundled together in mutual funds and passed off as secure places for Americans’ nest eggs. That very “bundling,” which was supposed to render the funds safer than individual securities by spreading out risk, actually made it easier to bury bad investments amid the good ones. Many of these funds turned out to be like the stacks of 20s proffered by counterfeiters, with genuine bills showing on the outside and the fake stuff sandwiched in between.

Sometime after I was fired from the Voice in the wake of its 2005 takeover by the New Times chain, a cheery young man called from the 401(k) company. He introduced himself as Joe and offered to guide me into switching my funds to an Individual Retirement Account. Having been impressed by my interviews with John Bogle, I told him I was thinking of moving my money to Vanguard. He demurred, saying he would personally provide me with all the help I needed, offering me private phone numbers and so on. I felt like Joe wanted to be friends. He explained how my money was to be invested, much of it in fixed-rate instruments, and I agreed.

Time passed, the market took a downturn, and I noticed on one of my monthly statements that the fixed-rate investments had disappeared, replaced by what looked like a money market account.

I called the company and asked for my old friend Joe. Joe wasn’t available, I was told, but another adviser would help me. A man got on the phone and explained that my instruments had “matured.” I said that I was nervous and wanted to get into something really safe, even if at a lower rate. The man quickly assured me that the market was fine, just going through one of its temporary corrections. But every investor was different, he said, and he was anxious to find my “comfort level.” I said that to be on the safe side, since I’d recently turned 70, I would like to invest in US Treasuries, perhaps of an intermediate term. He was silent for a moment, then finally said, “Let me get a real expert on the phone. You’ll be speaking to Robert. He’s a veteran of the market and knows bonds in and out.”

There was a pause, and Robert got on the phone. I told him I was thinking about Treasuries, and he let out a bellow of laughter. “Good god, no,” said Robert. “That would be terrible. Nobody—nobody should put money into Treasuries.”

“But…”

“NO. That would be foolhardy. I have been in this a long time,” Robert said. “The market goes up. The market goes down. Don’t worry about it.” He sounded a lot like Frankie had 45 years earlier on the armory roof. Robert assured me that everything would be all right. In fact, he said, this would be a good time to take advantage of the downturn and buy more stocks while they were cheap.

I said goodbye, not wanting to upset Robert further. He sounded like he might be about to have a stroke. I later learned that Treasuries have a far smaller sales margin than stocks and bonds.

I finally did move my money to another mutual fund company. Following its advice, I put it in a bundle of indexed funds that were supposed to be good for old people who might need to start using the money soon. These so-called target-date funds had relatively low proportions of stocks. Not low enough, as it turned out.

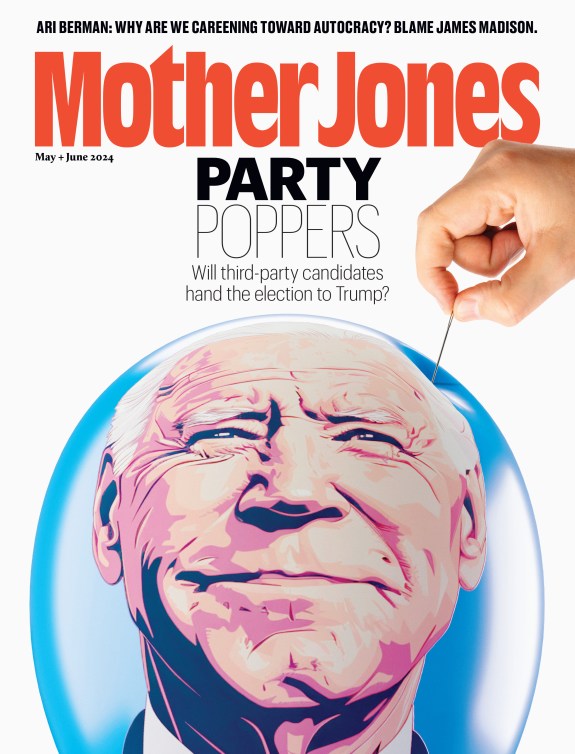

In 2008, the average value of stock mutual funds dropped 38 percent; bond funds dropped 8 percent. Among 401(k) holders, older people who had worked and contributed for 20 years or more, and amassed substantial savings, fared the worst, losing an average of about 25 percent of value, even after counting the money they added through the years. (On top of that, many companies—including Mother Jones—have suspended employer matching for retirement accounts as a result of the economic crisis.)

As for the supposedly safe target-date funds, those designed for investors planning to retire in 2010—less than a year from now—they lost 22 percent. That’s about what my losses have come to. If I’d moved into Treasuries, as my instincts dictated, I wouldn’t have earned much, but my principal would have been protected.

SO WHAT happens next? George Soros, the genius commodities man, says there is no bottom in sight for the market. Nouriel Roubini, a.k.a. “Dr. Doom,” the New York University professor who has been predicting disaster for years, says the American capitalist financial system has collapsed and cannot be revived. Vanguard’s John Bogle, who predicted the recession two years ago, sees the market continuing to sink before recovery begins. “This is the most difficult set of market conditions I have seen,” he told me. Stocks may recover over the next decade, but by then I may be dead. What do I do? “If you can’t afford to lose another red cent,” Bogle told me when I interviewed him again at the end of January, “you must get out of the stock market.”

But to go where? It’s too late for me—but clearly the time has come to reform the system that got us to this point. One substantive idea comes from Teresa Ghilarducci, a professor of economics at the New School in New York City who was asked to draw up a pension-reform proposal for the Economic Policy Institute. The institute’s proposal is for a “mixed system” that relies on “a strong defined-benefit pension system and a strong Social Security system.” To this it adds what it calls “Guaranteed Retirement Accounts,” under which workers who don’t have access to a defined-benefit plan would be required to put 2.5 percent of their income (matched with another 2.5 percent from their employers) into investment funds run by Social Security and earning a rate of return guaranteed by the federal government.

Modest though it may be, this proposal sadly represents the outer edge of a political debate that is more likely to end up with yet another wishy-washy compromise. As part of its new budget, for example, the Obama administration in February laid out plans for what it calls “a system of automatic workplace pensions, to operate alongside Social Security, that is expected to dramatically increase” retirement and personal savings. The term “pension” in this case is grossly misleading: The plan does little more than require employers that don’t offer retirement plans already to enroll employees in a “direct-deposit IRA account” unless they opt out. This pretty much amounts to 401(k)s for all, with the difference being perhaps some improvement in regulation.

Likewise, Congress, never one to throw up obstacles to the advancement of the mutual fund industry, is considering changes to 401(k) structure to head off a rising chorus of screams from angry geezers, who make up a growing sector of the electorate. Proposals include a tepid remake of the 401(k), adding on portability and preventing companies from using the plan assets to prop up their own stocks and bonds.

“There are all sorts of reforms that could be helpful—but only at the margins,” notes Karen Ferguson, director of the Pension Rights Center and a leader in a new coalition called Retirement USA, who has long argued for a change in the nation’s retirement structure. These reforms range from disclosure of fees to better conflict-of-interest rules on investment advice to adding a fund that only invests in government securities. But, Ferguson notes, none of these changes would “produce either adequate or secure incomes.” And unlike the Economic Policy Institute’s plan, all of these approaches preserve the power and profits of Wall Street investment banks.

Some economists find this all needlessly complicated. James K. Galbraith, University of Texas economist and MoJo contributor (see “How Social Security Can Save Us All“), wants to see a simple but decisive change: Increase Social Security benefits to the point that people can live off them, leaving the 401(k)s, in effect, to swing in the wind. Conservatives, on the other hand, want to cut Social Security and other old-age entitlements to prevent the mythical collapse of a supposedly insolvent system. (In fact, as Dean Baker of the Center for Economic and Policy Research has pointed out, Social Security has proved far more solvent and sound than anything Wall Street has produced.)

In any case, with banks hanging by a thread, Wall Street hemorrhaging bailout funds, a growing mass of unemployed workers, and a continuing decline of economic activity, retirement concerns will likely end up last in line. What will older folks do? I can only speak for myself. After getting myself out of the stock market and doing my best to cut expenses (and lower my standard of living), I’m working on accepting the fact that the idea of retirement is over. And I have to wonder if someday the tale of a foolish generation of Americans, who imagined that a lifetime of work would be rewarded with a comfortable and secure old age, will become just another footnote in the annals of the market.