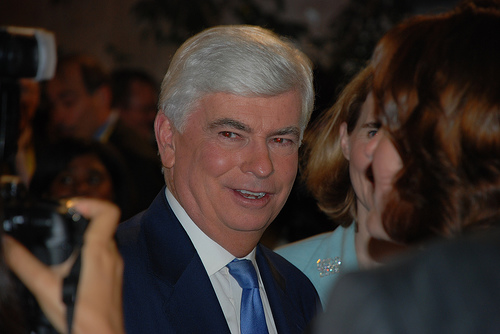

Flickr/<a href="http://www.flickr.com/photos/davidberkowitz/2851354225/">David Berkowitz</a>.

[UPDATE]: Talking Points Memo is reporting that Dodd intends to drop his death-by-study amendment on spinning off big banks’ swaps desk. TPM quotes a couple of anonymous Senate Democratic aides who say the Connecticut senator plans to ditch the amendment after taking a lot of heat from the financial sector, liberal lawmakers, and especially the proposal’s author, Sen. Blanche Lincoln (D-Ark.).

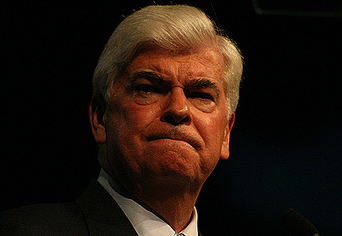

Sen. Chris Dodd (D-Conn.) quietly sought to end yesterday one of the most contentious battles in the Senate’s Wall Street overhaul: how to reform derivatives, the complex financial products that can be used safely—to hedge risk and protect against swings in the market—or to make risky gambles on swings in financial markets. A proposal from Sen. Blanche Lincoln (D-Ark.), who’s emerged as a derivatives reform crusader, would’ve forced big banks like JPMorgan Chase and Citigroup to cut out their lucrative, highly profitable “swaps” trading desks and make them separate subsidiaries. The logic behind Lincoln’s proposal is that banks engaging in risky swaps trading shouldn’t have access to federal (i.e., taxpayer) support when needed, and that if they want to retain access to those funds, they need to cut loose their swaps desks. Lincoln’s proposals have been vehemently contested by Wall Street, and opposed even by the White House and respected outsiders like Paul Volcker, the former Federal Reserve chairman.

Just before Tuesday’s deadline for submitting amendments, Dodd, a top Democratic senator on financial reform, filed one that he presumably thought would appease everyone. To his credit, the Lincoln swaps desk language will remain. But here’s the catch: The rule will be “studied” for two years before any action. As I’ve written before, calling for a study is essentially committing a rule to a slow, prolonged death. It’s a tactic straight out of the GOP playbook in this year’s financial reform battle when they wanted to kill a part of the bill without blatantly doing so.

From the looks of it, few people—except Dodd himself—are happy with the swaps-desk study. Lobbyists for the financial industry said the uncertainty created by the study amendment would “introduce a comic amount of uncertainty.” In a statement to the Washington Post, Lincoln said, “I remain fully committed to my provision and will fight efforts to weaken it.” But with time for debate in the Senate just about over—Majority Leader Harry Reid wants to vote on the bill in the next day or two—it looks like Dodd’s study amendment, despite Lincoln’s avowed opposition, will most likely end up in the Senate’s reform bill.