If the US Chamber of Commerce was the kind of nuts-and-bolts business association that its name suggests, it would stay out of the debate over extending the Bush-era tax cuts for millionaires and billionaires. After all, the personal income tax doesn’t directly affect the companies that the Chamber claims as members. And if stimulating the overall economy was the Chamber’s goal, then a smarter use of the money would have been to extend unemployment benefits for 800,000 US workers who’ve lost their jobs. So why has the nation’s most powerful business lobby made tax cuts for the über-wealthy a top priority?

Chamber Watch, a union-backed watchdog group, has dug up one possible answer: Self-dealing. The people who control the Chamber’s purse strings are the same corporate CEOs who populate the top of the personal income tax bracket. In a report released yesterday, Chamber Watch itemizes some of the biggest tax-cut-extensions that could befall the Chamber’s best friends:

- Rupert Murdoch, the CEO of News Corporation, whose donation of $1 million to the U.S. Chamber of Commerce led to well-publicized shareholder outrage, would pocket more than $1.3 million.

- Don Blankenship, a former U.S. Chamber Board member and the CEO of Massey Energy, whose company owned the mine in which twenty-nine miners died in April 2010’s mining disaster, the worst in forty years, would take home more than $700,000.

- David Cote, the CEO of Honeywell and a member of the National Fiscal Commission, who keynoted an address to the National Chamber Foundation expressing concern about the national debt over the next ten years, would get a tax cut of over $1.2 million.

- CEOs of big banks on Wall Street, who helped collapse the economy and then used the U.S. Chamber to fight stronger financial regulations, stand to reap between $700,000 and $1.6 million each.

- The CEOs of the health insurance industry, whose industry saw an overall increase in profits this year even while they slashed benefits and instituted breathtaking premium increases, are looking to personally benefit from another hit on the middle class by taking in between $335,000 and $875,000.

- U.S. Chamber President and CEO, Thomas Donohue, who has shifted the Chamber’s focus from serving mainstream business to serving mainstream business to serving the interests of CEOs who write the biggest checks, will personally gain over $200,000.

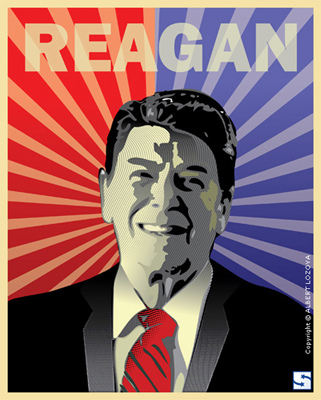

Of course, the Chamber’s other motive for backing tax breaks for the rich is probably ideological. Maybe a group that sides with the GOP as much as the Chamber does is hardwired not to realize that Reaganomics has proved time and again to be a catastrophic failure. Whatever the reason for the Chamber’s trickle-down love, though, very little of it is getting to the 98 percent of Americans who aren’t in the top tax bracket.