This article was produced by the investigative reporting workshop at American University in partnership with New America Media.

Graphic by Allen Meyer

Graphic by Allen Meyer

|

1995 |

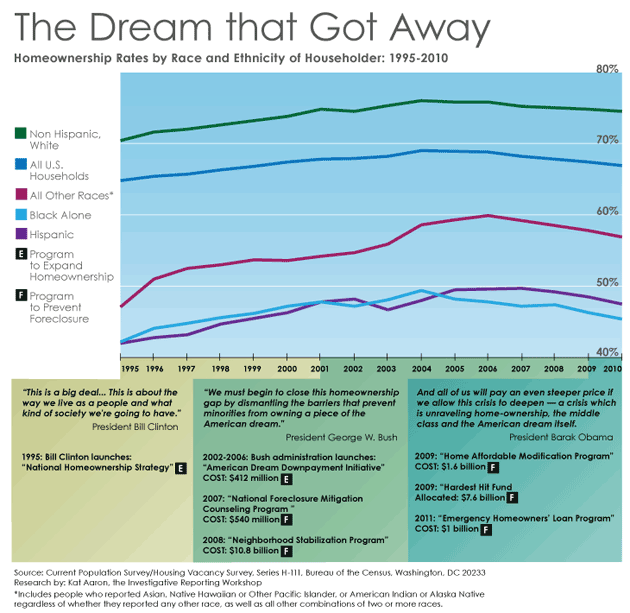

President Bill Clinton’s National Homeownership Strategy aimed to create 8 million new homeowners by 2000 through an “unprecedented collaboration of private and public housing industry organizations.” The program was going to “help moderate-income families who pay high rents but haven’t been able to save enough for a down payment; to help lower-income, working families who are ready to assume the responsibilities of homeownership but are held back by mortgage costs that are just out of reach; (and to) help families who have historically been excluded from homeownership.” At the 1995 ceremony announcing the plan, Clinton’s rhetoric was almost metaphysical: Homes were more than bricks and mortar. They were part of the intangible promise of America. “This is a big deal,” the president said. “This is about more than money and sticks and boards and windows. This is about the way we live as a people and what kind of society we’re going to have.” Not everyone was as sanguine about housing as the president. The Department of Housing and Urban Development produced an urban policy brief the same year that took a hard look at the pros and cons of homeownership. “The ideal of homeownership is so integral a part of the American dream that its value for individuals, for families, for communities and for society is scarcely questioned,” the brief read. “However, many external factors can affect whether and at what rate a home’s value increases or decreases.” Homeownership could be a key builder of wealth, but low-income and minority families were particularly “vulnerable to economic downturns that can result in job loss and, eventually, foreclosure,” the brief continued. |

|

1999 |

Ameriquest, a subprime lender whose slogan was “Proud Sponsor of the American Dream,” became the first subprime lender to have its loans financed by Fannie Mae (the Federal National Mortgage Association). The lender that pioneered “no-document” loans eventually settled for $325 million with several attorneys general over charges of predatory lending, in 2006. Ameriquest closed in 2008. |

|

2000 |

Five years after announcing his strategy, Clinton could boast a homeownership rate of 67 percent. African-American and Latino homeowners still lagged behind whites, but they were making clear gains. |

|

2002 |

By 2002, the administration had changed hands, but the American-dream language was still going strong. “We must begin to close this homeownership gap by dismantling the barriers that prevent minorities from owning a piece of the American dream,” President George W. Bush said in a June 2002 radio address. The Bush administration’s “ownership society” framed homeownership as an engine to help eliminate persistent racial inequalities. Building on Clinton’s goal seven years earlier, Bush set out to create 5.5 million new minority homeowners by the end of decade. President Bush put cash behind the ownership society goals. From 2002 to 2006, the administration spent $412 million on its American Dream Downpayment Initiative to help first-time homebuyers with costs associated with down payments. His administration also ramped up spending on housing counseling, the thinking being that education led to responsible homeowners. Grants for counseling totaled $176 million over the same four-year period. And more than $440 billion was committed by Fannie Mae, Freddie Mac (the Federal Home Loan Mortgage Corp.) and the other government-backed mortgage players, targeted toward making loans available to minority homeowners. Mortgage lenders jumped on the bandwagon, ramping up lending to communities of color — never mind that the loans were often high cost and packed with provisions like balloon payments and adjustable rates that turned them into ticking time bombs. |

|

2003 |

Angelo Mozilo, head of mortgage lender Countrywide Financial, delivered a lecture in 2003 entitled “The American Dream of Homeownership: From Cliché to Mission.” He explained his company’s purpose: “We wanted to make the American dream of homeownership something tangible — something to which people could do much more than just aspire. We wanted to make it something they could access, afford and achieve. We wanted to prove that our company could and would succeed by offering home loans to hard-working families — of all races and of all ethnic backgrounds,” Mozilo said. “In other words, it has always been our intention to be more than a corporation that makes mortgage loans; we wanted to be a force in making positive differences in people’s lives. Our goal was — and still is — to demonstrate that there is a unique role for the private sector in public service.” Mozilo also played a unique role in the financial crisis: His company made nearly $100 billion in subprime loans between 2005 and 2007, more than any other lender. Mozilo paid $67.5 million to the Securities and Exchange Commission in 2010, to settle charges of insider trading, misleading investors and disclosure violation. |

|

2005 |

Although no one knew it at the time, 2005 marked the high-water mark of American homeownership. The national rate of homeownership was 69 percent. Some 76 percent of white Americans owned a home, compared to 49 percent of black Americans and 48 percent of Hispanic Americans. |

|

2008 |

Barack Obama referenced the American dream in his first speech as president, in Chicago’s Grant Park, on Nov. 6, 2008. “This is our moment,” he said. “This is our time, to put our people back to work and open doors of opportunity for our kids; to restore prosperity and promote the cause of peace; to reclaim the American dream and reaffirm that fundamental truth, that out of many, we are one; that while we breathe, we hope.” |

|

2009 |

A year later, Obama invoked the dream again—three times in one speech—this time, in the context of exploding foreclosures. As he announced the creation of a $75 billion plan to address the housing crisis, he noted that “the American dream is being tested by a home mortgage crisis that not only threatens the stability of our economy but also the stability of families and neighborhoods. It is a crisis that strikes at the heart of the middle class: The homes in which we invest our savings, build our lives, raise our families, and plant roots in our communities.” |

|

2011 |

Despite more than 15 years of commitments to the American dream, almost all of the gains in homeownership made since Clinton launched his plan have been erased. Nearly a quarter of Americans owed more on their homes than they were worth in the first quarter of 2011. For underwater borrowers, their homes are not building household wealth, but draining it. Fewer Americans own homes now than in 1998. The gap between African-American and white homeownership has actually grown by 2 percent since 1995. |