Brian Cahn/Zuma Read on for the Mother Jones news team’s instant analysis of Tuesday night’s GOP presidential debate at Dartmouth College in Hanover, New Hampshire.

Brian Cahn/Zuma Read on for the Mother Jones news team’s instant analysis of Tuesday night’s GOP presidential debate at Dartmouth College in Hanover, New Hampshire.

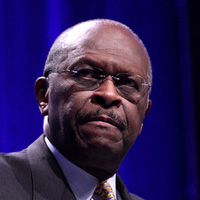

Rick Perry Continues to Sink Into the Sunset

Gov. Rick Perry/Flickr

Gov. Rick Perry/Flickr

I only saw half of tonight’s debate because I forgot that Bloomberg even had a TV channel. When I remembered and went looking for it, I discovered that I do indeed get BloombergTV on my cable plan thanks to last year’s upgrade to digital. So now I know. In the end, though, I ended up watching the streaming version anyway since that made it more convenient to make snarky tweets in real time.

Rick Perry continues to amaze. I mean, after his last disastrous outing, he must have known that Job No. 1 was looking like he was ready for prime time. Instead, he looked completely unprepared, as if he was surprised that people were still asking him actual questions instead of just nominating him on the spot. Check out this response to a Romney monologue on China and the decline of American manufacturing:

What we need to be focused on in this country today is not whether or not we are going to have this policy or that policy. What we need to be focused on is how we get American working again. That’s where we need to be focused.

And let me tell you, we are sitting on this absolute treasure trove of energy in this country. And I don’t need 9-9-9. We don’t need any plan to pass Congress. We need to get a president of the United States that is committed to passing the types of regulations, pulling the regulations back, freeing this country to go develop the energy industry that we have in this country.

Holy cow. That’s all he’s got after three weeks of prep? We have to quit talking about “this policy or that policy,” or worrying about Congress, and instead just man up and kick the economy in the balls? Urk. And when Karen Tumulty cross-examined him over the similarity of his Texas investment fund to Solyndra, he looked like a deer in headlights even though you could have seen this question coming a mile away. Perry is barely ready for public access cable, let alone prime time.

(I got some grief a couple of months ago for suggesting that Perry just wasn’t very bright: “Americans might not care if their presidents are geniuses,” I said, “but there’s a limit to how doltish they can be too.” Anyone still want to give me any grief about that? I freely admit that this isn’t the biggest reason he’s falling in the polls, but I think it’s one of the reasons. And it’s a big reason he’s losing the invisible primary: Insiders are assessing his obvious unwillingness to put in even the minimal work needed to address simple questions in a debate and concluding that he’s just flatly not up to the job.)

What else? Nothing really. The candidates in general continue to occupy some weird alternate universe where our biggest financial problem is that Wall Street is too regulated, our biggest health problem is that Medicare keeps denying treatments to old people, and our biggest economic problem is the intolerable burden of taxation we place on rich people. On an individual level, Rick Santorum continues to be bitter that so few people like him. Herman Cain continues to be a novelty candidate who can deliver sound bites with the conviction of a CEO giving a speech at a motivational seminar. Michele Bachmann continues to be out of it. And Mitt Romney continues to be strangely invulnerable to attacks. I know that Romney has so many negatives that it seems impossible for him to win, but somebody has to win, and I have a hard time seeing how it can be anyone else. The race is still his to lose.

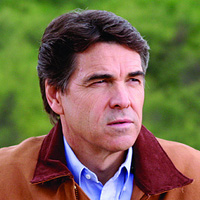

Herman Cain’s 9-9-9 Plan Raises Taxes on the Poor

Gage Skidmore/Flickr

Gage Skidmore/Flickr

If you watched Tuesday evening’s GOP presidential debate, you heard a lot about Herman Cain’s 9-9-9 plan. For the unfamiliar, it’s pretty straightforward: 9 percent corporate tax, 9 percent sales tax, and 9 percent income tax. Win-win-win! Or maybe not. Cain was asked at the debate to explain away the charge that his 9-9-9 plan would effectively raise taxes on low-income workers. (Among other things, Cain’s plan would implement a sales tax on groceries, which only two states currently do.)

Cain rejected the notion, but the facts are pretty clearly not on his side. Don’t take it from me, though. None other than Bruce Bartlett, a former economic adviser to Ronald Reagan and George H.W. Bush, says so. Here’s how he explained it at the New York Times‘ Economix blog earlier this week:

It’s important to understand that the 9 percent rates on personal and business income would apply to very different tax bases than now exist. For individuals, the tax would apply to gross income less only the deduction for charitable contributions. No mention is made of a personal exemption.

This means that the 47 percent of tax filers who now pay no federal income taxes will pay 9 percent on their total income. And elimination of the payroll tax won’t even help half of them because the earned income tax credit, which Mr. Cain would abolish, offsets both their income tax liability and their payroll tax payment as well.

Additionally, everyone would now pay a 9 percent sales tax on all purchases. No mention is made of any exemptions from this tax, so we may assume that it will apply to food, medical care, rent, home and auto purchases and a wide variety of other expenditures now exempt from state sales taxes. This would increase their cost of living by 9 percent while, at the same time, the poor would pay income taxes.

Bartlett, no lefty, calls Cain’s plan a “distributional monstrosity.” The Center for American Progress, meanwhile, found that the lowest quintile of earners would pay nine times more under the 9-9-9 plan—18 percent of their total income, versus 2 percent today.

Perry: If You Drill It, the Jobs Will Come

Gov. Rick Perry/Flickr

Gov. Rick Perry/Flickr

In the opening minutes of tonight’s debate, Rick Perry teased his jobs plan: Drill. Drill. And drill some more.

Which would be a great start, if energy companies hadn’t been doing gangbusters over the past decade, while doing close to nothing to help the economy get back on track:

Perry’s plan won’t be ready for a few days yet. But, evidently, it’ll keep corporate profits high and employment numbers low.

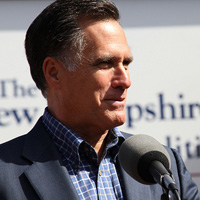

Romney Dodges Questions About Bain Legacy at Debate

Mitt Romney/Flickr

Mitt Romney/Flickr

If nothing else, Mitt Romney came prepared to Tuesday’s GOP presidential debate. While his top rival Rick Perry seemed only semi-alert (perhaps he needs more sleep?), Romney was more than up to the task of responding to a steady stream of jabs from the field’s also-rans. He told Herman Cain that sometimes short and simple plans are “inadequate” when the Georgia businessman asked Romney to recite his economic plan from memory.* And when former Utah Gov. Jon Huntsman challenged Romney on his record at the private equity firm Bain Capital, stating (accurately) that Romney was not a job creator, he fought back. Hard.

Here’s what Huntsman asked: “Some might see you because of your past employment with Bain Capital as more of a financial engineer, somebody who breaks down businesses, destroys jobs, as opposed to creating jobs and opportunity, leveraging up, spinning off, enriching shareholders. Since you were No. 47 as governor of the state of Massachusetts—where we were No. 1, for example—and the whole discussion around this campaign is going to be job creation, how can you win that debate given your background?” Romney had been asked a variation of the question at previous debates, but this time he came prepared with specifics:

Well, my background is quite different than you describe, Jon. (Chuckles.) So the way I’ll win it is by telling people an accurate rendition of what I’ve done in my life. And fortunately, people in New Hampshire, living next door, have a pretty good sense of that. They understand that in the business I was in, we didn’t take things apart and cut them off and sell them off. We—we instead helped start businesses. And they know some of the names. We started Staples, we started the Sports Authority, we started Bright Horizons children centers. Heck, we even started a steel mill in a farm field in Indiana. And that steel mill operates today and employs a lot of people. So we began businesses.

None of this really changes the bottom line, which is that when Romney ran Bain he was responsible for a lot of people losing their jobs. But at least from a political standpoint, Romney was able to diffuse the line of attack. And that wasn’t the only sign that Romney was playing at a higher level than the rest of the field: Given the chance to ask a question of his own to any other candidate at the table, he wisely chose to lob a softball at Michele Bachmann, who poses virtually no threat to his own candidacy but could help derail Perry in Iowa.

*This really happened.

Joe Burbank/Orlando Sentinel/Zuma

Joe Burbank/Orlando Sentinel/Zuma

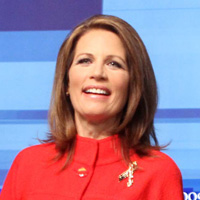

No, Michele Bachmann, Fannie and Freddie Didn’t Cause the Financial Crisis

At Tuesday evening’s GOP presidential debate at Dartmouth, Michele Bachmann was asked by the Washington Post‘s Karen Tumulty whether she believed Wall Street had ever really paid for the financial crisis it caused. The Minnesota congresswoman, whose campaign has hit a rut of late, rejected the premise. She argued instead that the financial crisis had been created by the policies of Fannie Mae and Freddie Mac, the quasi-governmental housing agencies.

It’s an enticing narrative for conservatives—pin the blame on government lending money to poor people—but it’s not true. My colleague Andy Kroll explained over a year ago why exactly this is wrong:

A look at the actual data shows that Fannie and Freddie—while certainly plagued with problems—are not the root causes of the subprime mortgage meltdown nor the financial collapse. First, context: Fannie and Freddie’s roles, in part, consisted of buying up lots of mortgages in the secondary mortgage markets, i.e., taking them off the books of mortgage originators, and allowing those originators to extend more credit to potential homeowners. Over time, the two GSEs’ positions as secondary purchasers of mortgages was used to try to expand homeownership to groups of Americans that traditionally didn’t have access to this kind of credit—namely, low-income citizens.

Now to Barry Ritholtz. An financial expert and wildly popular blogger, Ritholtz has written time and time again about the lunacy of blaming Fannie and Freddie. He’s so sure of his position that he’s offered $100,000 to anyone who can prove him wrong. Here’s Ritholtz debunking the Fannie and Freddie meme:

- The origination of subprime loans came primarily from non-bank lenders not covered by the [Community Reinvestment Act, a law pushing the two GSEs to purchase more loans in the secondary markets and thus expand access to housing loans to low-income neighborhoods]

- The majority of the underwriting, at least for the first few years of the boom, were by these same non-bank lenders;

- When the big banks began chasing subprime, it was due to the profit motive, not any mandate from the President (a Republican) or the Congress (Republican controlled) or the GSEs they oversaw;

- Prior to 2005, nearly all of these sub-prime loans were bought by Wall Street—NOT Fannie & Freddie;

- In fact, prior to 2005, the GSEs were not permitted to purchase non-conforming mortgages;

- The change in FNM/FRE conforming mortgage purchases in 2005 was not due to any legislation or marching orders from the President (a Republican) or the the Congress (Republican controlled). It was the profit motive that led them to this action.

Anyway, check out the whole post. Bachmann’s telling a whopper. But unlike some of her others, don’t expect Bachmann’s opponents to call her out on it.

Javier/Flickr

Javier/Flickr

Herman Cain on Alan Greenspan: He’s My Guy

Toward the tail end of Tuesday night’s WaPo-Bloomberg debate, the Washington Post‘s Karen Tumulty asked Herman Cain who he felt was the most successful Federal Reserve chairman. Cain briskly responded with “Alan Greenspan,” saying that “the way he coordinated with all of the Federal Reserve banks” was admirable. Fellow candidate Ron Paul then (predictably) followed up with a blunt “Alan Greenspan was a disaster.”

Cain’s response warrants a double take: Even Alan Greenspan publicly acknowledged that Alan Greenspan was an abject disaster. As David Corn reported three years ago, during a congressional hearing in October 2008, the Reagan-appointed, pseudo-objectivist Fed chairman admitted that his libertarian worldview didn’t exactly pan out:

With members of the House oversight and government reform committee blasting Greenspan for his past decisions that helped pave the way for the current financial crisis, he acknowledged that his libertarian view of markets and the financial world had not worked out so well. “You know,” he told the legislators, “that’s precisely the reason I was shocked, because I have been going for 40 years or more with very considerable evidence that it was working exceptionally well.” While Greenspan did defend his various decisions, he admitted that his faith in the ability of free and loosely-regulated markets to produce the best outcomes had been shaken: “I made a mistake in presuming that the self-interests of organizations, specifically banks and others, were such as that they were best capable of protecting their own shareholders and their equity in the firms.”…Greenspan, one of the more ideological Washington players of the past few decades, essentially said that Ayn Randism had let him—and the entire world—down. It was truly a God that failed.

Along with his self-admitted record of failure, Greenspan, in his 2004 memoir The Age of Turbulence: Adventures in a New World, seems to mainly reserve kind words for President Clinton (whom he described as having a “consistent, disciplined focus on long-term economic growth”), while heavily bashing Republican leaders from Richard Nixon to both Bushes. Anyway, read David’s whole piece.

The Jury’s Still Out on Perry’s Enterprise Fund

At Tuesday night’s debate, Gov. Rick Perry was asked about the Texas Enterprise Fund (TEF), one of his key job creation initiatives. Perry boasted about the 54,600 jobs the program supposedly created, and the $14 billion-plus in capital investment it has brought to Texas. (The fund works by giving companies taxpayer money in exchange for them agreeing to add jobs in Texas, usually by moving their operations there.)

Perry didn’t really explain why some of the recipients of fat grants and huge tax breaks are some of his biggest donors, and it’s still not clear how many jobs TEF really created. As I reported back in September:

In January 2010, Perry’s office claimed that TEF had created 54,600 jobs since it began in 2003. But company-reported data shows that, by the end of 2009, fewer than 23,000 jobs could be attributed to TEF. And two-thirds of TEF-backed companies failed to meet their job targets. The program handed out nearly $440 million during that period…

The program also suffers from a conspicuous lack of transparency, according to Andrew Wheat, the research director for [Texans for Public Justice]. Wheat says that his colleagues intended to use government data from 2010 to assess the program, but they were forced to rely on numbers from 2009. “We put in a request to get that data covering 2010,” he said. “We’re still waiting.”…

Don Baylor, a senior policy analyst at the Center for Public Policy Priorities, says there is no way to verify Perry’s claims more broadly. “It’s quite simply not possible to know whether these companies would have come to Texas without the cash,” Baylor says.

There’s just no way of knowing whether all the money Perry spent on drawing companies to Texas actually created any jobs. So the jury should still be out on that Texas miracle.

Who Is Herman Cain’s Brain?

Answering a question about who he takes economic advice from, Herman Cain unveiled his secret weapon: a man named Rich Lowrie.

Last month, Comedy Central did the legwork on tracking down who, exactly, Lowrie is: a management adviser with Wells Fargo. The same Wells Fargo that received $25 billion in TARP money.

How exactly does that jive with Cain’s free-market economic philosophy?

Bachmann Revives Debt Ceiling “Blank Check” Lie

In Tuesday night’s debate, Rep. Michele Bachmann (R-Minn.) resurrected a lie peddled by Reps. John Boehner and Eric Cantor during the debate over increasing the debt ceiling: that increasing the borrowing limit would be the equivalent of handing President Obama a “blank check.”

As David Corn pointed out back in July, this is just flat wrong:

[A] blank check enables future spending. Raising the debt ceiling is about permitting the US government to cover past spending—and the blank checks of the past. These particular blank checks were issued by the Republicans during the Bush years. They voted (with the help of some Democrats) for wars in Afghanistan and Iraq without budgeting for them. They did the same with a Medicare prescription-drug benefit. They also green-lighted President Bush’s tax cuts without accounting for the drop in revenue they would cause. Together these blank checks account for two-thirds of the deficit, if not more. (See this chart.) By claiming the debt ceiling is the problem, the Republicans are blaming the bank for the bank robber’s action.’

Moreover, raising the debt ceiling does not hand Obama any more authority to spend. Congress controls spending—and the Republicans control the House and have filibuster power within the Senate. If Republicans want to clamp down on spending, they can endeavor to do so through the appropriations process. Holding the line on the debt ceiling will not turn off any spigot. The United States will continue to run up debt; the government just won’t be able to pay its bills—which will likely lead to greater interest rates and, consequently, more debt.

None of this has prevented Republicans from deploying the blank-check accusation. Their heavy reliance on this rhetorical ammo suggests it’s been poll-vetted and focus-group-tested. When the political battle at hand involves government accounting—a matter that most Americans are not that familiar with—a simple and easy-to-understand metaphor can be rather helpful. After all, how many independent voters want a president with a blank check?