Deadly viruses don’t much care what’s in your wallet, but socioeconomic privilege and access to wealth do wonders when it comes to not just surviving a plague but cashing in on it. Having spent more than a year pre-COVID working on a new nonfiction book about the absurdity of wealth in America during this second Gilded Age, I figured the pandemic would throw a wrench into my story. Yet perhaps unsurprisingly, over the past year, the superrich have remained safely ensconced on their side of an economic chasm that just keeps widening as investment profits flow to the very top while America’s less fortunate struggle just to get by. I put together these stats to demonstrate the degree to which our most privileged citizens have benefitted, often at the expense of the rest of us.

Who’s on top?

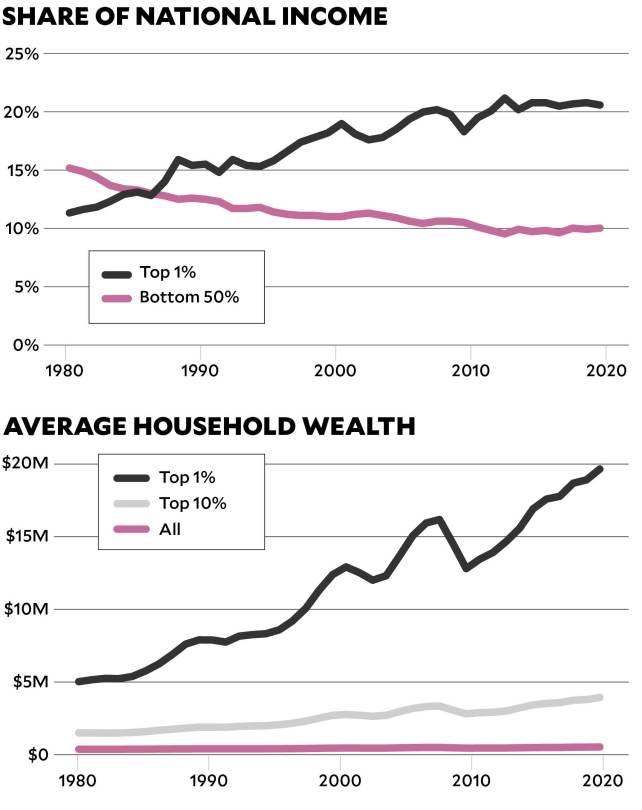

Long before the pandemic hit, America’s economic spoils flowed disproportionately to the top earners, while more than half of the population failed to thrive.

The Cares Act, passed in March 2020, included …

How the rich fared during the pandemic

In the first three months of 2020, the combined wealth of Americans with assets of $30 million or more dipped 26%—but then bounced back almost entirely by the end of August.

The pandemic relief passed in December 2020 included a bipartisan provision that will save America’s wealthiest 1 percent an estimated $120 billion in taxes.

In the pandemic’s first full year, the combined net worth of 657 American billionaires increased by nearly 45%—about $1.3 trillion.

How the rest fared

During that first pandemic year, 82 million people filed for unemployment benefits, and more than 100,000 businesses* shut down permanently.

In March 2021, more than 1 in 7 renters said they were behind on rent, as did roughly 1 in 5 renters of color. Meanwhile, 45 million Americans experienced food insecurity in 2020. That’s 10 million more than in 2019.

Noblesse oblige? Non.

Foundations and wealthy philanthropists—notably MacKenzie Scott—opened their wallets wider in 2020 to help the needy weather the pandemic, and also gave in response to the nationwide protests for racial equity. For example, in a Council on Foundations survey of 250 major foundation leaders, 60% said their organizations would distribute more money than initially planned—17% more on average. Which seems pretty generous, until you consider the growth of foundation endowments in 2020, driven by a booming stock market.

From March to December 2020 …

Not working

In 2020, the employment rate for people making less than $27,000 tumbled 28%. For those making more than $60,000, it dropped less than 2%.

Fired up

Average wages grew nearly 7% last year—but mostly because 7.9 million workers earning less than $14 per hour had lost their jobs.

Homework

76% of lower-income workers say their work cannot be done from home. Only 44% of upper-income workers say the same.

Stimulus response

The cares Act lifted more than 18 million people out of poverty in April 2020. But 14 million fell back in after the act’s unemployment benefits dried up.

The average personal income of Americans jumped 10% in January—almost entirely due to the second round of stimulus.

Sources (not linked above)

- Share of national income (chart): Thomas Pikkety, Emmanuel Saez, and Gabriel Zucman, “Distributional National Accounts: Methods and Estimates for the United States,” Quarterly Journal of Economics. Original paper and updated data series available here.

- Average household wealth (chart): See above; updated data series’.

- Cares Act breakdown: Americans for Tax Fairness

- How the rich fared: Wealth-X (proprietary ultrawealth data); Adam Looney, Brookings Institution (double-dip estimate); Institute for Policy Studies/Americans for Tax Fairness (billionaire gains, excluding billionaires for whom insufficient data was available)

- How the rest fared: Department of Labor (unemployment claims); Yelp (business closures—extrapolated to “more than 100,000” because just under that had shut down permanently by September 2020); Center on Budget and Policy Priorities (delinquent renters and food insecurity)

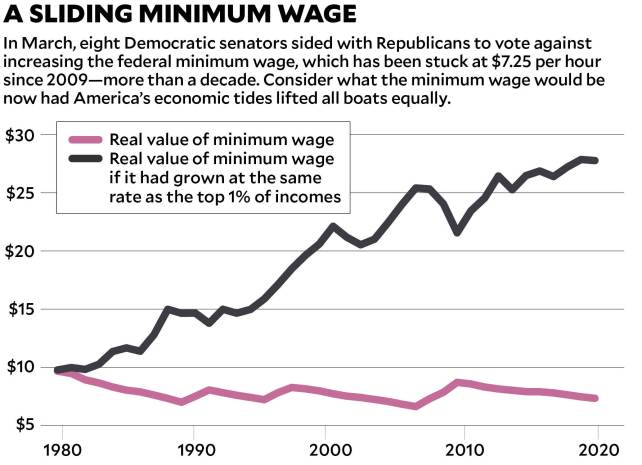

- A sliding minimum wage (chart): History of Federal Minimum Wage Rates Under the Fair Labor Standards Act

- Noblesse oblige? Non: Council on Foundations (survey); Kiplinger (market performance)

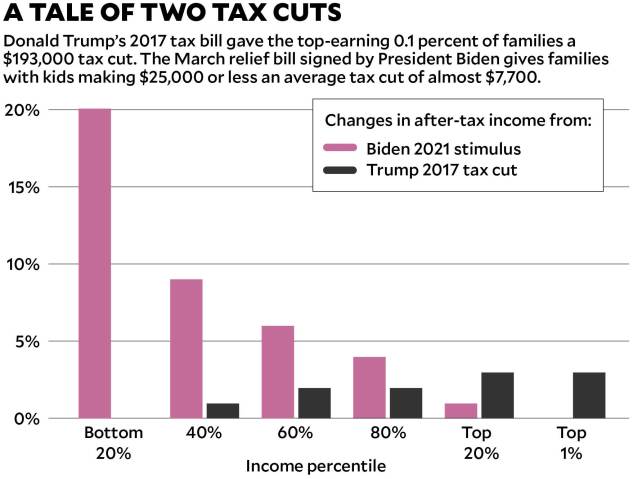

- A tale of two tax cuts (chart): Urban-Brookings Tax Policy Center (Trump, Biden)

- From March to December 2020… (chart): Brookings Institution

- Stimulus response: Lifted out of poverty/fell back in; personal income gains