Donald TrumpEvan Vucci/AP

A New York judge ruled on Friday that former President Donald Trump must pay $355 million and cease doing any business in New York for three years after being found liable for years of deceiving banks and insurance companies about his net worth. While Trump has said he will appeal the decision, if the ruling stands, it would potentially obliterate his financial resources. What’s more, it comes on top of an earlier decision by the same judge to revoke Trump’s license to operate businesses in New York. Between the payments and the license revocation, Trump’s business career would likely be in serious jeopardy, at least in the state of New York. But, with an appeals process that is expected to last several years, his fate is far from settled.

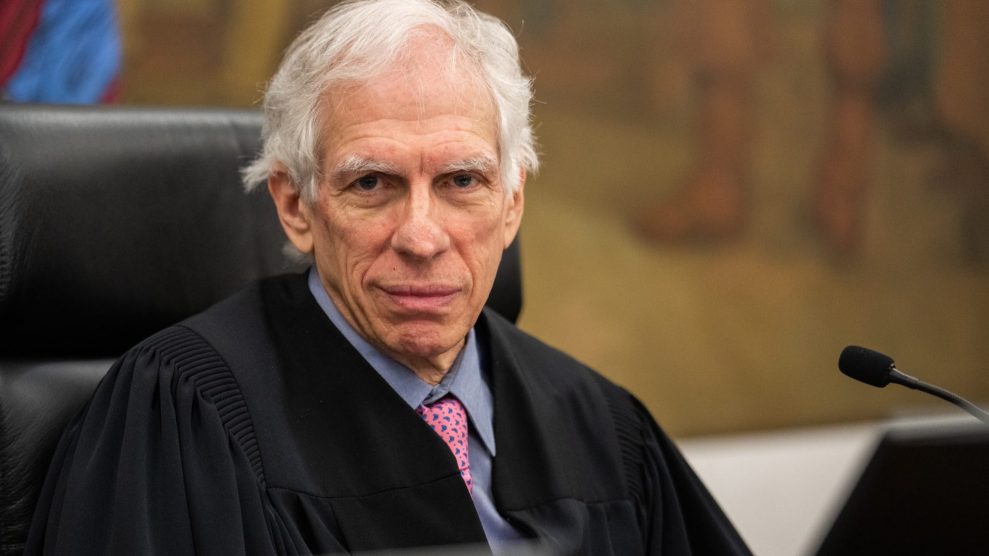

The decision, issued by New York Superior Court judge Arthur Engoron, is the result of a civil fraud case brought by New York Attorney General Letitia James. James accused Trump of telling banks and insurance companies that his assets were worth far more than they really were in an effort to get better deals on loans and insurance policies. Among other falsehoods, Trump told banks was that condos in New York were worth tens of millions on the open market, when in actuality they were rent-controlled and unavailable to sold, and that his Mar-a-Lago resort was worth hundreds of millions or even as much as $1.5 billion, when in reality, because of deed restrictions, it would likely be worth just a fraction of that.

Over the course of several months this past fall, Trump’s attorneys wrangled with James’ legal team, and just as often with Engoron, bitterly denying Trump had done anything wrong. But the fact that Trump was liable for the fraud was never really in question throughout the trial—after Trump’s team largely failed to address any of James’ accusations directly, Engoron ruled before the trial even began that Trump had indeed acted fraudulently. The trial essentially was to determine exactly how much Trump would owe for his fraudulent behavior. James’ called a string of witnesses, including former Deutsche Bank employees, to testify that they would never have given Trump such good terms for loans and insurance policies. Trump and his attorneys continually maintained that Trump had paid his creditors back and had paid his insurance policy bills, so there was no effective harm done.

The trial was especially notable for the clashes between Trump and Engoron. After Trump repeatedly used his social media account to complain about Engoron’s clerk, the judge issued a limited gag order prohibiting the former president from denigrating courtroom staff. When Trump violated the order—twice—Engoron fined him and eventually forced Trump to testify. Engoron ruled Trump’s testimony on the subject was “not credible.” Trump later lashed out against Engoron when he returned to the stand to testify in the trial, and at one point he stomped out of court, Engoron refused to dismiss the case. None of the theatrics seemed to help the former president. The case also named Trump’s adult children and a number of his top employees at the Trump Organization.